As any corporate treasurer knows, while Know Your Customer (KYC) checks are essential to maintaining the integrity of the financial network, there’s no doubt they can be inefficient and time-consuming. We spoke to Unilever about how they use Swift’s KYC Registry to overcome the challenges these compliance checks pose.

Meet Unilever

Unilever is one of the world’s leading suppliers of beauty & personal care, home care and foods & refreshment products, with sales in over 190 countries and more than 2.5 billion daily users. Over half of the company’s footprint is in developing and emerging markets, with around 400 brands found in homes all over the world – including iconic global brands like Dove, Lifebuoy, Knorr, Magnum, OMO and Surf, as well as Love Beauty & Planet, Hourglass, Seventh Generation and The Vegetarian Butcher. For a company with 149,000 employees and sales of €50.7 billion in 2020, a multi-banking relationship is essential for it to run smoothly.

This is a tool that becomes better with every user that joins, and I’d encourage any corporate with a multi-banking relationship to get onboard if they’re burdened by KYC checks.

Alleviating the burden of KYC checks

With operations spanning the globe, fulfilling requests for KYC information can be a sizeable task, especially when dealing with multiple banking partners across different regions and jurisdictions. The lack of standardisation means that the information requested by banks to complete KYC often changes from one check to the next, and can consume a large amount of the treasury team’s time.

“Before we joined Swift’s KYC Registry, the process of completing a KYC check was a very labour-intensive process,” says Rosanna Summerville, Treasury Manager Global Transaction Banking & Processes at Unilever. “We often receive multiple requests from different banks simultaneously – completing those manually used to take a long time and prevent us from getting on with other tasks. Sourcing information across different internal departments, chasing signatures and communicating back and forth with our banks via email was a real challenge.”

Frustrated by having to repeatedly satisfy these administrative requests, Unilever sought a more streamlined solution. The company joined 17 other corporates and 16 global banks in a pilot working group for the registry, to trial its effectiveness and provide feedback for its future development.

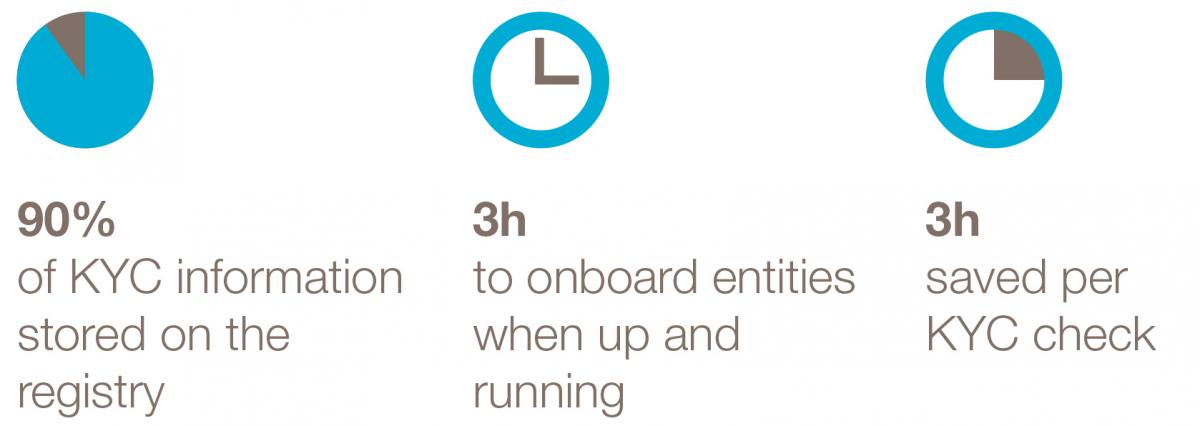

“Swift’s KYC Registry is an incredibly useful tool that takes away the inefficiencies of KYC checks, and has the potential to make corporate compliance processes far more productive,” continues Summerville. “About 90% of the information needed for our KYC checks can be uploaded to the registry – all we have to do is accept the banks’ requests and the system does the rest.”

Dedicated support to get you up and running

While it can take time to get used a new tool, Swift’s operational team strives to make this process as easy as possible for both corporates and banks. We accelerate the process of populating baseline information for you, so you can achieve immediate efficiency savings.

“Many of our banking partners are already using the registry within correspondent banking, which was one of the greatest advantages of using this tool,” says Summerville. “It’s important that you are prepared and have all the relevant documents ready before you begin the onboarding process – this will speed things up. It took some time to get used to the system, upload our first entity and understand how to get the most out of it, but now that initial investment has paid off in KYC time savings.”

“The registry allows you to have a more proactive approach to KYC checks, rather than being reactive,” says Gerard Tuinenburg, Treasury Director at Unilever. “It releases the pressure that comes with fulfilling banks’ requests, and once you’re onboarded it’s really just a case of ensuring your information is up to date. Swift are always quick to reply to any questions we may have – I’ve been really impressed with the support we’ve received since joining. This is a tool that becomes better with every user that joins, and I’d encourage any corporate with a multi-banking relationship to get onboard if they’re burdened by KYC checks.”

Want to know more?

To find out more about the benefits of Swift’s KYC Registry, and learn how you can sign up, go to swift.com/kycregistry