Combine the power of Swift GPI with domestic real-time payments infrastructure

Customers today expect their international payments to be as seamless and fast as their domestic ones. That means payments made in seconds, with real-time confirmation of credit.

However, when there are multiple banks involved in the payment chain, and the final leg needs to be cleared within the recipient country, the domestic payments are sometimes delayed owing to the limited operating hours of the local clearing systems.

With the advent of real-time payments systems, which typically operate 24/7, there is an opportunity to remove these last frictions and ensure that these payments are credited in seconds rather than hours.

Our solution

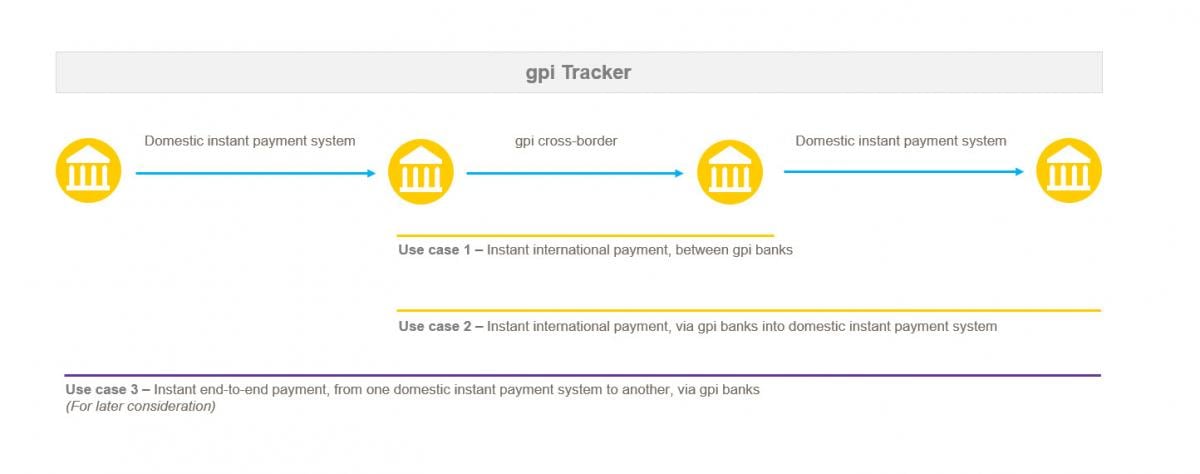

gpi instant payments service combine the power of gpi with domestic real-time payment networks, to make cross-border payments as fast and as seamless as domestic payments.

It provides an enhanced service that enables participating banks to send / receive cross-border payments end-to-end, in near real time, and beyond their regular hours of business.

Values and benefits

Position yourself as a payments leader

By embracing cross border real-time payments, you can position yourself as a front-runner in the payments business offering a best-in-class service level.

Deliver a better customer experience

Provide a better experience across your full client portfolio, including corporate, SME and retail, driving new business opportunities.

Lay foundations for new services

Leverage the frictionless experience of instant payments to build new value-added service enhancements in the ecommerce or merchant acquiring space.

Bring real-time cross-border to your market

By providing a seamless payments experience in your local market, you can attract more business, investment and economic activity.

Adopt globally interoperable standard

Harnessing the globally recognised standard of Swift GPI enables you and your banking community to build bridges with new markets.

Bring new efficiencies to your local economy

Provide a boost to local financial institutions and businesses by enabling better liquidity management, more innovation and more flexibility.

How to get started

Get in touch with your Swift Relationship Manager

Are you interested in delivering instant cross-border payments? Get in touch with your Swift Relationship Manager to get started.