Why settle for settlement fails?

Imagine if you could track a securities transaction from end to end throughout the entire settlement lifecycle.

This transparency could open many doors: increasing your operational efficiency, speeding up investigations and settlement, improving customer experience, bringing down costs, and driving innovation.

Transparency is also key to avoiding settlement fails, a challenge that’s costing the securities industry billions of dollars each year.

With regulatory penalties now in place for late settlement, and the shift towards T+1 and shorter settlement cycles accelerating around the world, settlement efficiency is more important than ever ..

Get a better view

Swift Securities View allows you to track securities transactions from end-to-end throughout their entire lifecycle.

It does this by leveraging the Unique Transaction Identifier (UTI) – an ISO standard – which is used to link all Swift messages related to the same securities settlement flow.

The transparency offered by Swift Securities View helps you react quickly to detect and resolve exceptions, so you can avoid or limit penalties for late settlement.

Through increased transparency, we aim to help you reduce operational risk and costs, improve straight-through processing and boost settlement efficiency.

See Swift Securities View in action

In this 5-minute demo, discover all the key features available on the Swift Securities View dashboard.

Main benefits

Reduces costs

Through end-to-end transparency, you can identify and resolve problems in the settlement process, driving efficiencies and reducing the likelihood of incurring regulatory fines.

Drives better decision-making

Provides a mutual (historical) end-to-end view on transactions for all settlement parties, enabling faster and better decision-making to correct settlement exceptions.

Helps support interoperability

Enables better connectivity between counterparties and makes it easier to transmit and track transactions between traditional and next-generation technologies.

Flexible connectivity options

Access via GUI or integrate it into your back-office systems and client portals using multiple channels including API and MT notifications.

What our customers say

Don't just take it from us. Hear how users around the world are fighting friction with Swift Securities View.

Who’s using Swift Securities View?

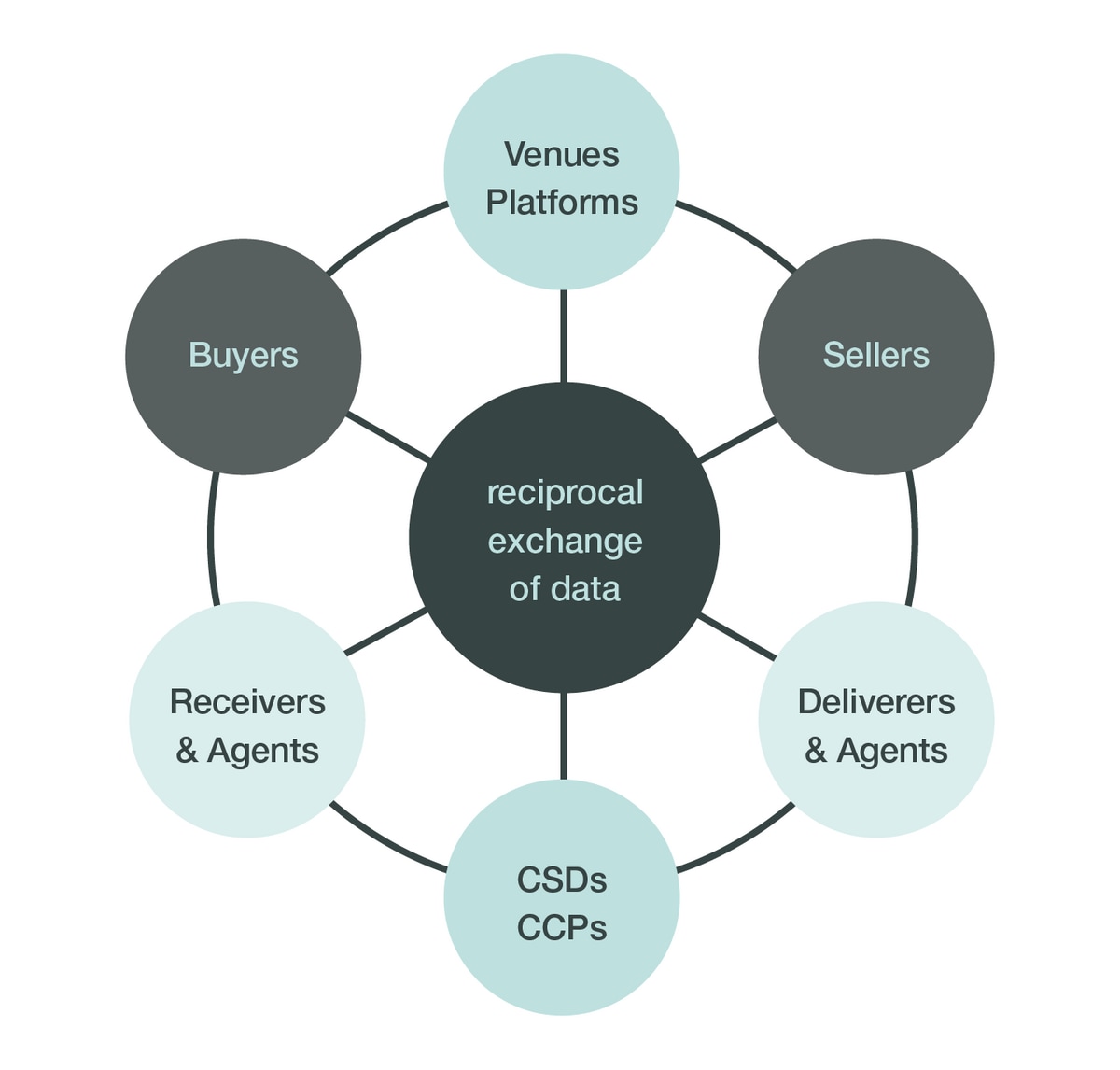

The service was developed in collaboration with our community and counts participants from all stages in the settlement process among its active members – including asset managers, outsourcers, brokers, global and sub custodians, CSDs.

|

Abu Dhabi Investment Authority (ADIA) Banco Santander BNY Mellon Centralni Depozitar Cennych Papiru China Citic Bank Citco Group of Companies Citibank Europe, (Organizacni Slozka) Compagnie Monegasque De Banque S Credit Suisse Custody Bank of Japan

|

Dinosaur Merchant Bank Edmond De Rothschild Euronext Securities Copenhagen First Abu Dhabi Bank Global Evolution HSBC Securities Services Hypo Tirol Bank J.P. Morgan Securities Legal & General Investment Management Mitsubishi UFJ Asset Management Nomura Asset Management |

Nomura Bank Luxembourg Northern Trust Investment Operations Outsourcing Raiffeisen Bank International SEB The Northern Trust Company Van De Put And Co Private Bankers Volksbank Wien |

How it works

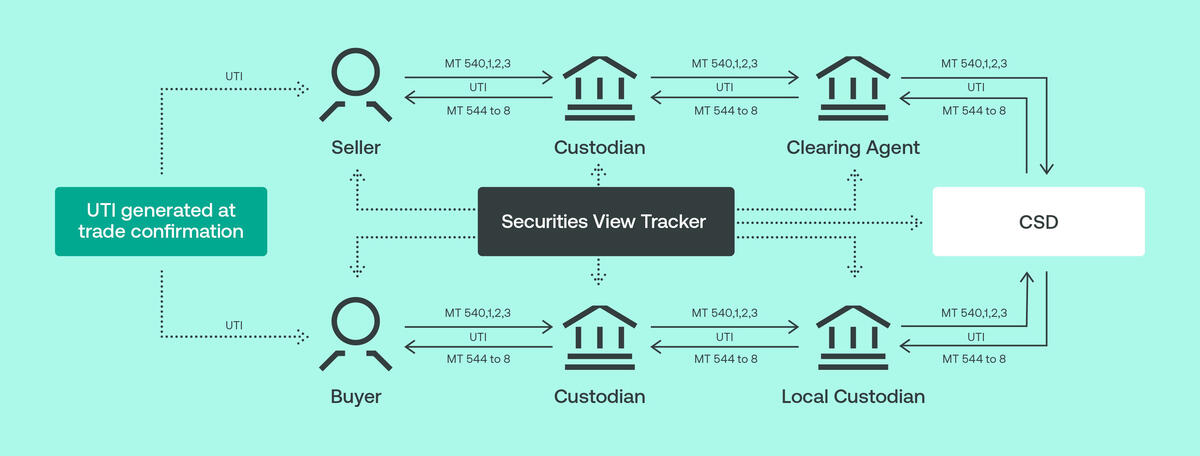

Swift Securities View gives you the data and tools you need to improve visibility and understanding of your securities settlement transactions. It leverages the settlement data carried in ISO 15022 MT messages, including a Unique Transaction Identifier.

The service provides an early warning of issues that today are typically detected later in the settlement chain, such as discrepancies between buy and sell instructions or if a counterparty’s instruction is missing.

You can access Swift Securities View through a GUI or integrate it into your back-office systems and client portals using multiple channels including API and MT notifications.

See Swift Securities View in action – In this 5-minute demo, discover all the key features available on the Swift Securities View dashboard.

1 -

A UTI is generated and assigned to a securities trade, as part of the trade allocation or confirmation process between a buyer and a seller. This could be over a centralised trading venue, matching platform, or by an instructing party in the case of a bilateral trade.

2 -

Buyer and seller include the UTI in their Swift settlement instruction to their respective custodians.

3 -

The custodian(s) receive, process, and persist the same UTI in their outgoing transfers to their next agent(s) or CSD.

4 -

All parties continue to process and persist the UTI in all related Swift settlement messages.

5 -

Thanks to the UTI, the Securities View Tracker provides tracking, comparison, and alerting information at every step of the flow (from initiation, (un)matching, cancellation, partial settlement, settlement) to all parties involved.

Start implementing the UTI

The Unique Transaction Identifier (UTI) is a unique 52-character alphanumeric code that is already used for securities financial transaction reporting.

By adopting it more widely in the securities settlement process, the industry can reduce operational risk, improve settlement and reconciliation efficiency, support interoperability, enable digital transformation and enhance customer experience.

While Swift Securities View can provide some complementary data and incremental improvements to users that have not yet integrated the UTI, once the UTI is adopted it drives automation and unlocks the full value and transparency provided by the service.

Learn more about the benefits of the UTI and download guidelines for implementing and communicating it.

How to get started with Securities View

Watch the demo

Start with an introduction to Swift Securities View.

Speak to an expert

Get in contact with Swift.

Developer Portal

Discover the Swift Securities View APIs services.

Ready to start?

Subscribe to Swift Securities View now.

Swift Securities View won Best New Asset Servicing Project at Global Custodian’s Leaders in Custody awards 2023.

This recognises the rapid uptake from the industry and significant potential of the service to improve transparency across post-trade settlement.