Banking is built on trust between counterparties. but what if trust is digitised in a decentralised future?

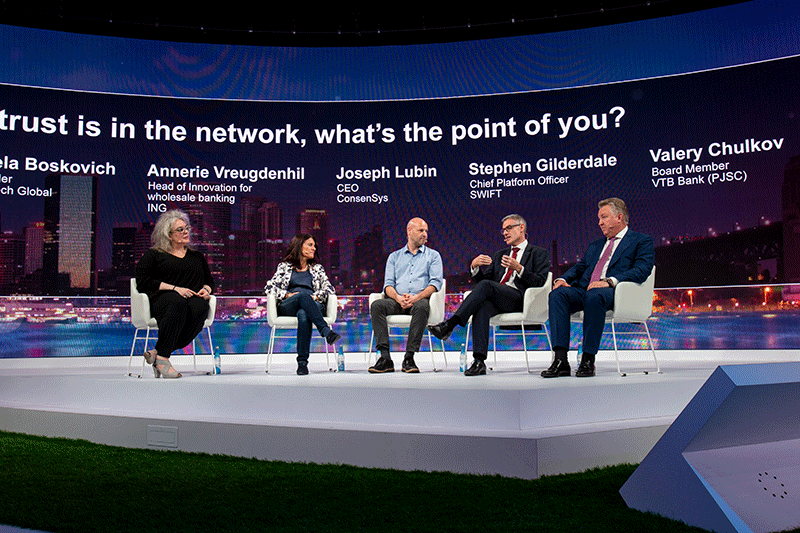

Let’s talk about trust. Monday at Innotribe 2018 was dominated by a single question. ‘If trust is in the network, what’s the point of you?’ was the title of a fascinating and practical early-afternoon panel discussion, but it was also a key theme for the whole day and a critical question for the future of the banking industry.

As the decentralised future fast approaches, financial industry players – and not just us, but our institutions and our customers – need to find our place, our role, our purpose in a very different social, commercial and competitive environment. At the same time, we as individuals will need to embark upon active management of our own identities and data, which already have commercial value, within a trust-based, decentralised network.

But how to do that? “Trust is what we need to commercialise,” day anchor Ghela Boskovich, founder, Femtech Global, told us. To trust a network, we must be confident about the security of our digital identity, i.e. our personal (and institutional) data. As explained by author Steven Berlin Johnson, ownership, control and portability of data underpin its fast-growing commercialisation.

When we can carry our data – our digital identities – with us, we can sell our attention. And our customers can sell their attention to us. Commoditising (and exercising control over) this exchange will be a core component of the commerce of the future. “I’m willing to let advertisers see this part of my life, or that, in return for deals, or cash,” said Johnson.

The future is already here

How close is this future? The work is already very much underway. The growth of collaborative tools such as open source software and blockchain, Johnson suggested, will play a significant role in bringing forth the business models that will turn this hypothetical scenario into reality.

Social media companies have already effectively met the “base layer need” for an open protocol for digitised identity, but a trusted infrastructure such as that offered by blockchain is also needed to decentralise control to individuals. In future, we will be able to take our data and our identities to a secure ‘account’ on the blockchain, and thereby place our trust and our trustworthiness in the network. “This is going to happen. Work with it,” said Johnson.

With these building blocks now emerging, all industries – especially those for which trust is inherent to their value proposition – will have to face these new challenges and opportunities.

Trust is what we need to commercialise

In the day’s marquee session – ‘If trust is in the network, what’s the point of you?’ – Boskovich emphasised the imperative. “We have to have a conversation about how we transact in a decentralised world where no central authority can validate and authenticate who and what we are,” she said. “Trust is now being infused into a technology platform, rather than a relationship organisation,” she asserted. In this transformed eco-system of data-empowered customers and counterparties, how do we transact? How do we win customers? How do we do business? Where will the banking industry’s value-add lie?

Is open source the way forward?

As we began to digest the business implications, the session also looked at the practical, operational aspects of a decentralised network, constructed of multiple nodes and populated by multiple actors.

“Decentralisation really ramifies across a number of dimensions. It’s a set of open source protocols. Open source has its own decentralised flavour; one can fork a project, for example,” said Joseph Lubin, CEO, ConsenSys. Fork? That idea got the room buzzing: in an open source environment, we can easily take a piece of software or source code off in a direction of our own choosing and develop our own solutions. We have already seen how the initial idea of Bitcoin quickly led to a whole host of new technologies and propositions; building on such innovations will only become easier as the open source era gathers momentum.

Bitcoin, of course, brought rise to the blockchain, which offers both practical and conceptual support for decentralised business models. Noting blockchain’s development from a mechanism enabling a narrow monetary system to a vehicle for multiple new business models in which trust and authority are no longer centralised, Lubin observed: “Decentralisation should be about giving us lots of options.”

But even a decentralised eco-system needs governance, panellists agreed. In an open source eco-system, governance structures must be sensitive to evolution, driven by multiple actors. There is no regulatory lag as a single authority catches up with the latest innovation. Decentralisation gives us the tools to innovate in an innovation-rich, inherently regulated eco-system.

If data is the new oil, what about us?

And yet if we’re here to talk about trust, and trust is infused in the network, what’s the point of us as individuals? Answer: we’re the drivers; every participant in the network – the eco-system – generates the data on which the network thrives. We supply the data that has been described as the oil driving the digital economy. The message that ‘we are the future’ was repeated, confirmed and amplified throughout Innotribe 2018.

How do we bridge from the present to the future? Discussing trade finance – still mired in “piles of papers”, Annerie Vreugdenhil, head of innovation for wholesale banking, ING, said: “All the actors in an eco-system have to start to trust this technology and adapt to it” if they are to achieve radical change. Trust begins with trusting the technology. But the incentive for that isn’t just efficiency; there’s also the prospect of seizing – or losing – the business opportunities offered in a very different world.

Monday’s whirlwind tour of a trust, digital identify and decentralised networks taught us to see ourselves as empowered, data-wealthy players in this new future. It also encouraged hundreds of conversations in the curated networking session that followed, with speakers and delegates diving deeper into every aspect of the day’s agenda.

The building blocks are largely in place, and the business models are now fast emerging. It is incumbent on banks to reconsider their role as trusted counterparties to institutional and individual clients in a world where trust is woven into decentralised networks. Whether collaborating to develop new data-driven micro-payment services, or supplying custody services for crypto-currencies, banks are already looking to the future.

Our first role – the point of us today – is to trust the technology, to adapt it and to enable it, to take up the opportunity that it offers.

Videos

Day 1: Session wrapups and interviews

Follow our participants

Brett King

Ghela Boskovich

Annerie Vreugdenhil

Steven Johnson

Chrity Wayua

Joe Lubin