Learn more about our experiments to enable tokenised assets to integrate seamlessly with the world’s existing financial ecosystem.

The current market capitalisation of tokenised assets – digital representations of assets such as stocks and bonds – is still relatively small. But that’s expected to change, with the World Economic Forum estimating that volumes could reach USD 24 trillion by 2027.

Yet challenges must be overcome before tokenised asset usage can really scale. That’s why we collaborated with Citi, Clearstream, Northern Trust and SETL in 2022, to conduct a series of experiments that assess how Swift’s existing infrastructure can be used to unlock the potential of this market.

Here are five key takeaways from our experiments to help you quickly get up to speed on the future of tokenisation in financial services.

1. The industry is fast gearing up for a tokenised future

Tokenisation could have a huge impact on finance, and our lives more generally. One potential benefit is fractionalisation, in which larger assets can be split into smaller parts, making investing accessible to people that previously didn’t have the resources to do so. Tokenisation could also condense settlement times, reduce the need for reconciliations, enable new forms of automation, and deliver greater transparency to securities trading more broadly.

Therefore, banks, securities firms and financial market infrastructures are acting quickly to respond to this trend – not just to define how they can access these new potential sources of value, but also to develop the servicing capabilities to support the full lifecycle of digital asset trades.

2. The barriers to growth shouldn’t be underestimated

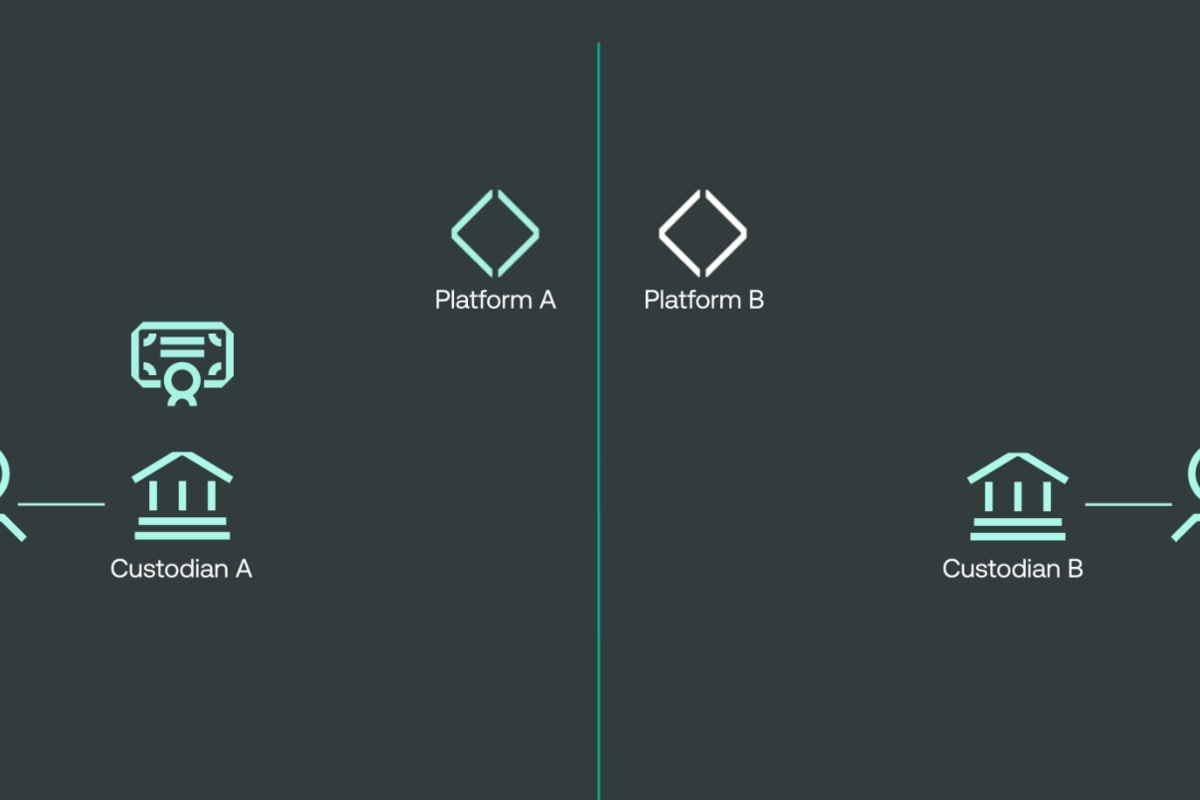

If tokenisation is to thrive, a series of hurdles will need to be cleared first. With various markets adopting their own technologies, platforms and regulatory environments for tokenised assets, the risk of fragmentation is very real. That’s why the ability to easily access multiple tokenised asset types residing on multiple different platforms will be essential.

Different securities market participants will also transition at different speeds, meaning that tokenised assets will have to co-exist with traditional assets for the foreseeable future. It will therefore be critical to enable interoperability and communication between participants and systems (traditional and new), as well as on-chain and off-chain markets during the transaction lifecycle of tokenised assets.

3. Our extensive tokenisation experiments have proved successful

In light of these challenges, we’ve been working with key industry players from across the tokenised and traditional asset ecosystem to explore how tokens can be seamlessly transferred and integrated into securities and payments processing.

Together, we successfully demonstrated how Swift’s infrastructure can support market participants to create, transfer, and redeem tokens – as well as update balances between multiple client wallets. We also showed how the de-tokenisation process could work.

4. Swift could act as a ‘single access point’ to various tokenisation networks

Today, Swift provides a single access point for securities players throughout the post-trade lifecycle across many asset classes (equities, fixed income, derivatives). Our experiments demonstrated that Swift’s infrastructure can similarly act as an interconnector and ‘single access point,’ linking up multiple tokenisation platforms and various cash leg payment types – Swift GPI, RTGS and CBDC – with participants interacting with tokenised assets via our platform.

The experiments highlighted the efficiencies that can be achieved for our members by accessing tokenised assets via their existing Swift connectivity channels, and that Swift messaging is fit for purpose to enable tokenised transaction types.

5. Feedback is essential to define the next steps

Following the success of these experiments, we’re reaching out to our community to gain feedback on our experiments with a view to further explore the feasibility of offering the solution demonstrated in the experiments as a service to Swift customers.

We’re also gaining feedback on the value of a further set of experiments with expanded use cases, such as reporting or asset servicing.

Want to learn more?

Download our report

You can also reach out to your Swift account manager or contact us.