The securities industry has made big leaps in efficiency over past decades, yet there are areas where the settlement journey still faces friction. In the first of three articles, Swift’s Head of Securities Strategy, Vikesh Patel, sets out a vision for the future of frictionless post-trade settlement.

With the end of year getting closer, I’m looking forward to the chance to spend quality time with family and friends – and try, at least, to embrace a slightly slower pace of life.

But we all know that in many contexts, speed remains critical. It’s useful to be able to move money between my accounts, or to make contributions to my pension fund more or less instantly. On a wider level, the ability to buy and trade stocks in real time makes for a responsive market, a nimble business world and a dynamic economy.

The post-trade space is also heading in this direction. Several territories are pushing for T+1 or even T+0 settlement. For now, the vast majority of settlement instructions are at T+2 or above – and achieving even that timescale can be challenging for a significant minority of transactions.

How billions drain away

Data from Swift business intelligence reveals that for every 100 securities transactions sent for settlement, five will not be completed on the expected settlement date. Data on settlement failures from the European Securities and Markets Authority (ESMA) supports this, suggesting that an average of 7% to 8% of equity settlements and 2% to 4% of bond trades fail.

These proportions seem small only if you ignore the overall values involved in the trades. They equate to billions of dollars lost to the industry every year.

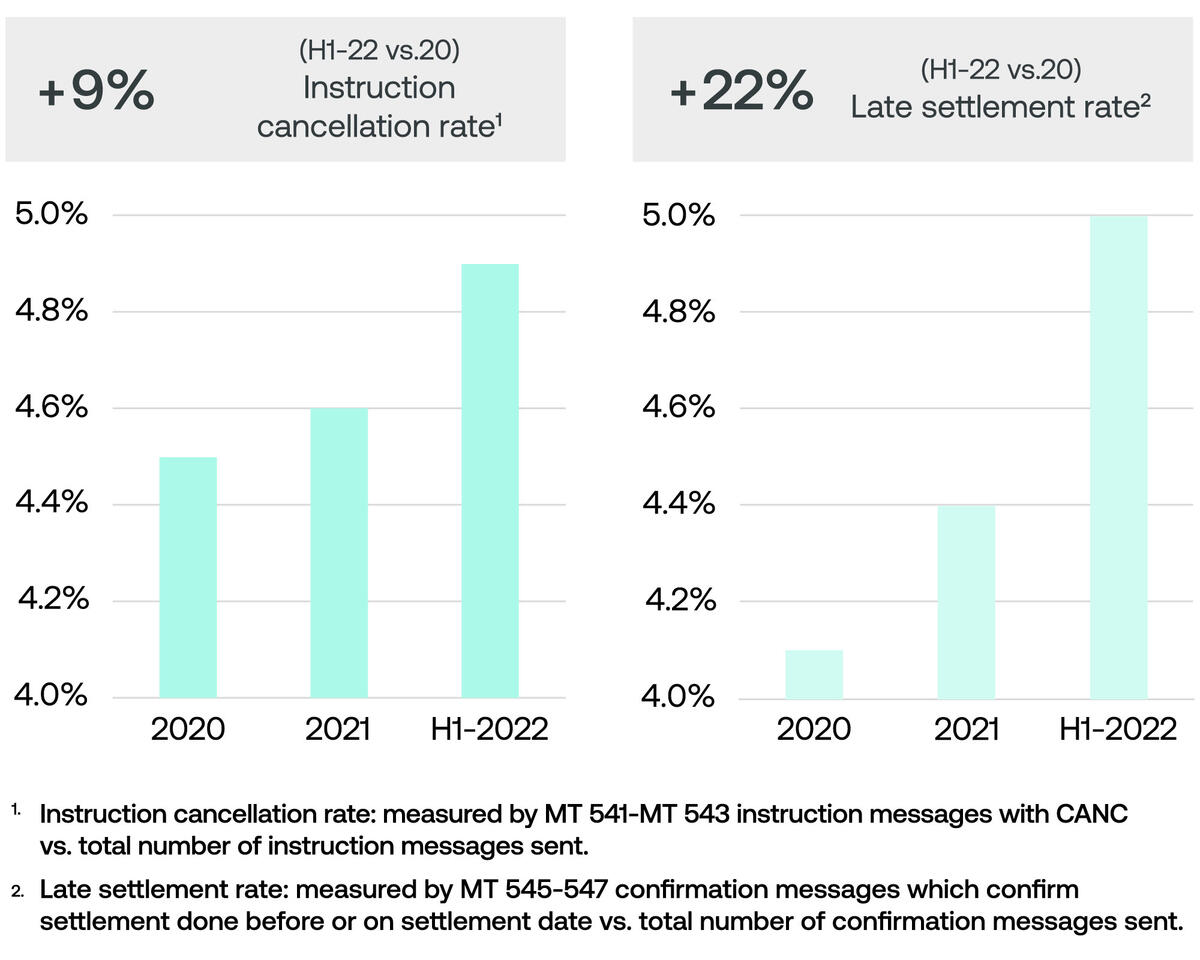

Nor is the outlook improving. In fact, late settlement and cancellation became more common in 2021, and this has continued in 2022 to date.

It’s true that the recent context has been one of market volatility and a significant hike in transaction volumes. But a resilient system must be able to cope with both of these circumstances – which, in any case, increasingly seem to be the norm.

The root causes of friction

Cross-border securities transactions can be prone to the friction that causes settlement failures. This may be understandable – international transactions entail longer chains, multiple regulatory jurisdictions, and a variety of message formats, data standards and tech platforms – but it’s not an excuse.

Inventory management is another faultline: ‘broker locate issues’, where securities are on loan and therefore unavailable, are often cited for failures. And, finally, another common reason is simple human error in entering data, for example in standing settlement instructions – especially among smaller firms, where manual processes are commonplace.

The cost of failure

What real difference does an annulled or delayed transaction make? For trading counterparties, the impact can be huge. We shouldn’t underestimate the effect for the investment fund that foregoes profit due to a missed opportunity, or for the business left exposed to credit risk when an anticipated stock fails to materialise.

For the provider, the immediate effect is that of providing a poor customer experience. Multiplied, poor experiences can lead to reputational damage.

Increasingly, penalty regimes are bringing a cost burden too, compounding the already acute pressure on margins. Daily charges are already being enforced through the new settlement discipline regime for transactions that settle in EU-domiciled central security depositories (CSDs). And while the plan to oblige trading parties to execute buy-ins against counterparties who fail to settle their trades has been postponed several times, mandatory buy-ins remain a real prospect from 2025.

Accelerated settlement cycles may only heighten these risks. With the US keen to shorten the cycle, and India already starting a gradual roll-out of T+1, settlement fails – and the associated penalties – could be set to increase.

Towards full-velocity trading

Given this trajectory, the current fail rate for post-trade settlement is clearly not sustainable. Nor, I would argue, is it inevitable.

The elimination of settlement inefficiencies and manual processing is surely not beyond our ingenuity and would support full trading velocity – providing the kind of seamless experience, in other words, already taken for granted in many of our personal transactions.

What can the industry do to achieve a frictionless future for post-trade activity? How can it innovate and reform to meet client demands, ensure the smooth allocation of capital, and set the foundation for the future? In my next article I’ll explore the opportunities within our grasp.

Read article two in this series: A work of friction? Drivers towards seamless securities settlement