The five ways to confirm payments

Table of contents

The Basic Tracker

To support non-gpi banks with limited cross-border payments volumes, our free Basic Tracker allows you to manually confirm payments.

Through the Basic Tracker, you can meet payment confirmation requirements, access basic search and tracking features, check your compliance with the mandate and have an easy upgrade path to the full version of the gpi Tracker if you wish.

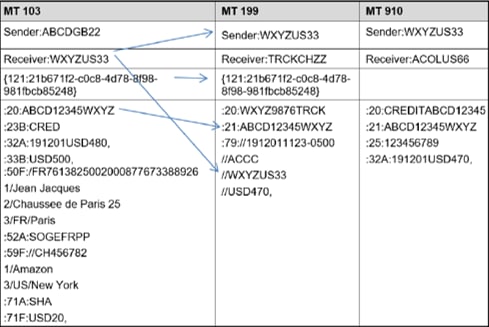

Automated MT 199 confirmations

You can confirm your payments by sending an interbank payment message (MT 199) to a dedicated gpi Tracker BIC through your existing Swift interface.

This message then triggers an update to the Tracker and provides payment confirmation to the ordering bank.

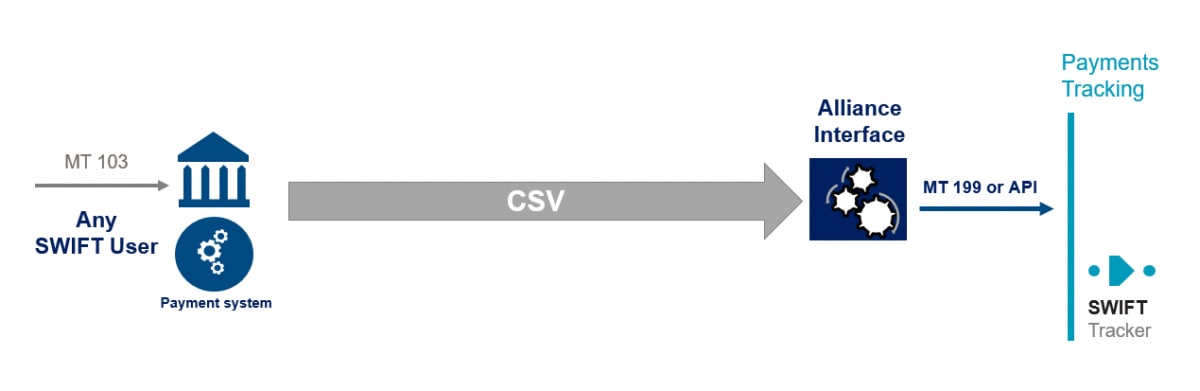

Batch confirmations

Our new CSV format (Comma Separated Values) can be used to reduce the implementation effort of Universal Confirmations to a simple end-of-day export file from your payment application.

To implement the CSV option to confirm payments, you need to assess that your payment system (proprietary or from your supplier) supports the generation of the CSV format provided by Swift.

Alliance Access or Entry consume the CSV files and will convert each entry in the file(s) into a payment status update to the Tracker.

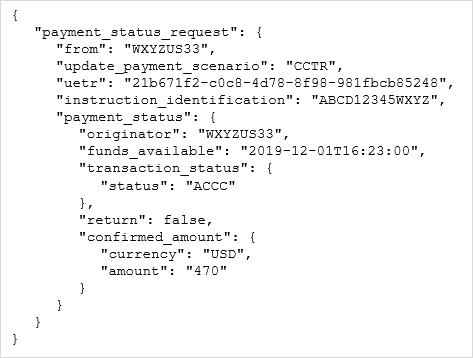

Confirm via API calls

Using API calls to confirm payments is a fast and efficient way to update the gpi Tracker. All Swift users can use the Swift SDK or the Swift Microgateway to update the Tracker using the unique tracking code of the transaction.

ISO 20022

To help reduce the burden for banks and ease the transition from MT, an ISO 20022-compliant messaging standard will also be available to provide confirmations to the Tracker.

In March 2020, the Swift Board and Executive endorsed ambitious plans for Swift to make the Swift platform richer, smarter and faster. To enable this, and acting on feedback from the community, Swift will enable ISO 20022 messages for cross-border payments and cash reporting businesses starting from the end of 2022. This extends the originally announced date by one year.

Swift has published in MyStandards the new Swift XML ISO channel for Universal Confirmations trck.001. This message can be used to confirm both MT 103 or pacs.008.

Get started

The Universal Confirmations deadline is 22 November 2020. From that date, you’ll need to provide status updates on ALL your incoming MT 103 messages.

Ready to get started? Log in to my Swift and access all the documentation you need to help you meet these new requirements.

[Webinar] How way to confirm your payments

Join us to find out more about the ways you can confirm payments, including our free Basic Tracker tool and our automated channels, and what you need to do to get started.