According to Swift data, the Chinese yuan overtook the Canadian and Australian dollar as a global payments currency in November 2014, and now takes position behind the Japanese Yen, British pound, Euro and US dollar.

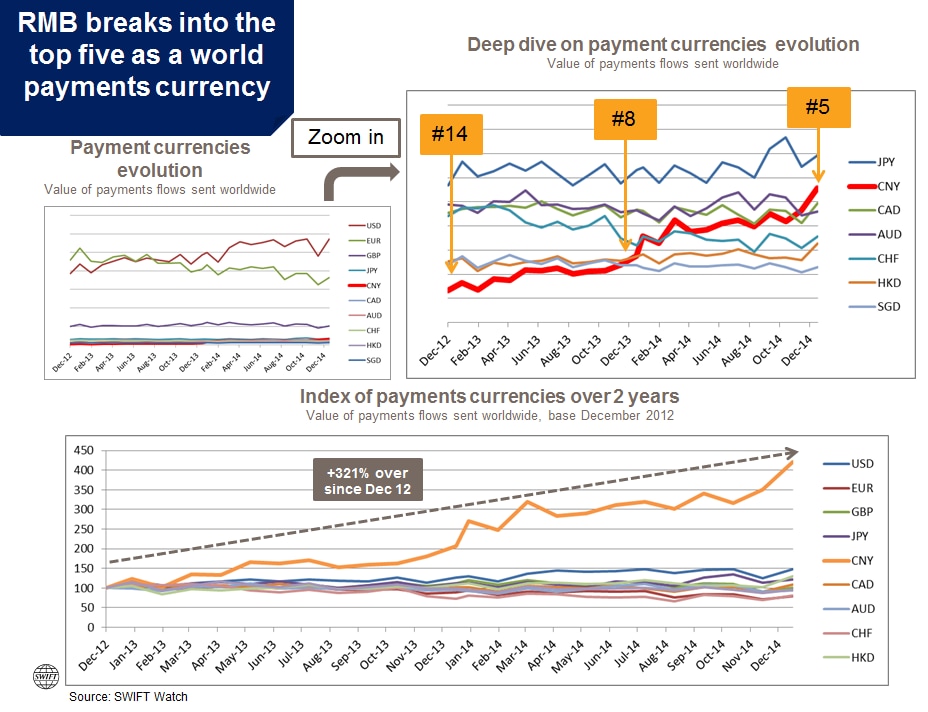

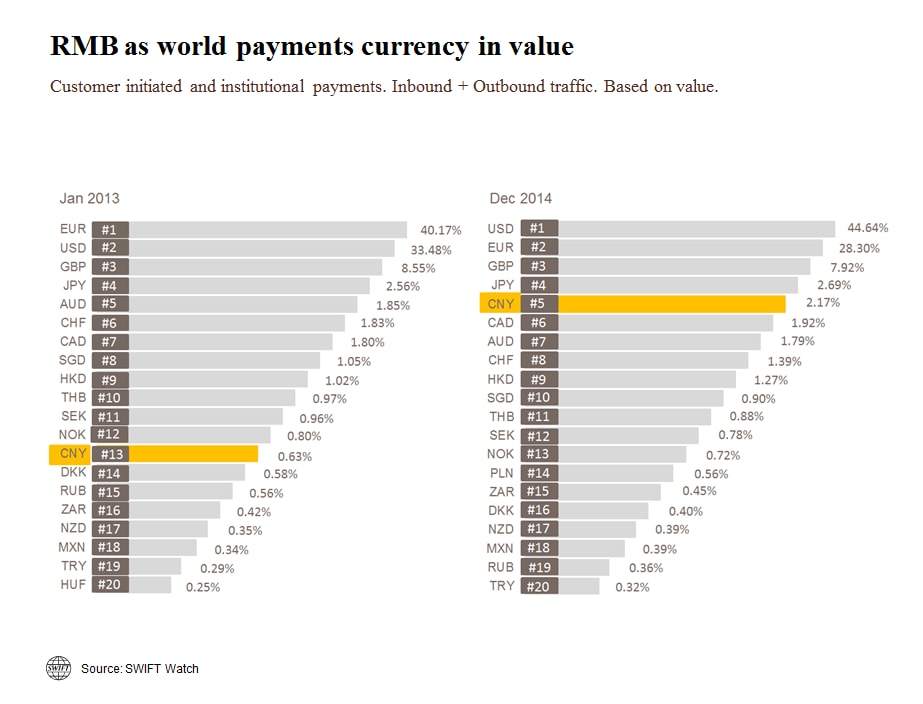

Brussels, 28 January 2015 – After nearly one year firmly positioned at #7, the Renminbi (“RMB”) has entered the top five of world payment currencies since November 2014, overtaking both the Canadian Dollar and the Australian Dollar by value. Just two years ago, in January 2013, the RMB was ranked at position #13 with a share of 0.63%. In December 2014, the RMB reached a record high share of 2.17% in global payments by value and now trails the Japanese Yen which has a share of 2.69%.

“The RMB breaking into the top five world payments currencies is an important milestone” says Wim Raymaekers, Head of Banking Markets at Swift. “It is a great testimony to the internationalisation of the RMB and confirms its transition from an “emerging” to a “business as usual” payment currency. The rise of various offshore RMB clearing centres around the world, including eight new agreements signed with the People’s Bank of China in 2014, was an important driver fuelling this growth”.

Overall, global RMB payments increased in value by 20.3% in December 2014, while the growth for payments across all currencies was 14.9%. The RMB has been showing a consistent three digit growth over the past two years with an increase in value of payments by +321%. Over the last year, RMB payments grew in value by 102% compared to an overall yearly growth for all currencies of 4.4%.

About Swift and RMB Internationalisation

Since 2010, Swift has actively supported its customers and the financial industry regarding RMB internationalisation through various publications and reports. Through its Business Intelligence Solutions team, Swift publishes key adoption statistics in the RMB Tracker, insights on the implications of RMB internationalisation, perspectives on RMB clearing and offshore clearing guidelines, supports bank’s commercial RMB product launches and provides in-depth analysis and business intelligence, as well as engaging with offshore clearing centres and the Chinese financial community to support the further internationalisation of the RMB.

The Swift network fully supports global RMB transactions, and its messaging services enable Chinese character transportation via Chinese Commercial Code (CCC) in FIN or via Chinese characters in MX (ISO 20022 messages). It offers a suite of dedicated RMB business intelligence products and services to support financial institutions and corporates. In addition, Swift collaborates with the community to publish the Offshore and Cross-Border RMB Best Practice Guidelines, which facilitate standardised RMB back office operations.

Please click here for more information about RMB Internationalisation or join our new ‘Business Intelligence Transaction Banking’ LinkedIn group.

About Swift

Swift is a member-owned cooperative that provides the communications platform, products and services to connect more than 10,800 banking organisations, securities institutions and corporate customers in over 200 countries and territories. Swift enables its users to exchange automated, standardised financial information securely and reliably, thereby lowering costs, reducing operational risk and eliminating operational inefficiencies. Swift also brings the financial community together to work collaboratively to shape market practice, define standards and debate issues of mutual interest.