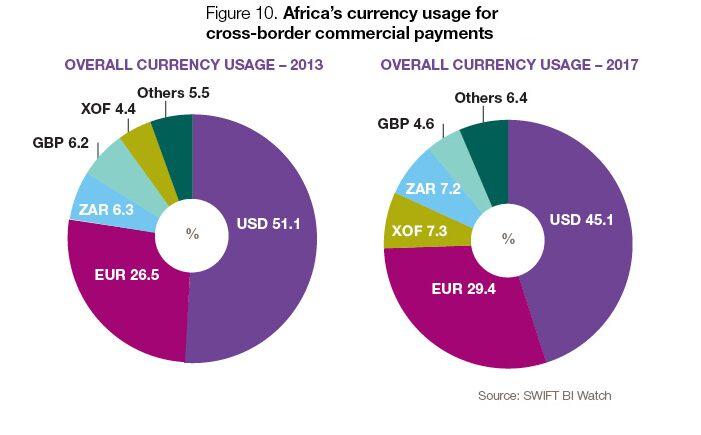

Use of US dollar declining while West African franc and South African rand increasing.

Today Swift publishes a new white paper mapping commercial payment flows against financial flows in Africa. The data reveals that intra-Africa payments and clearing is increasing in importance, and points to an increase in the use of African currencies for cross-border payments.

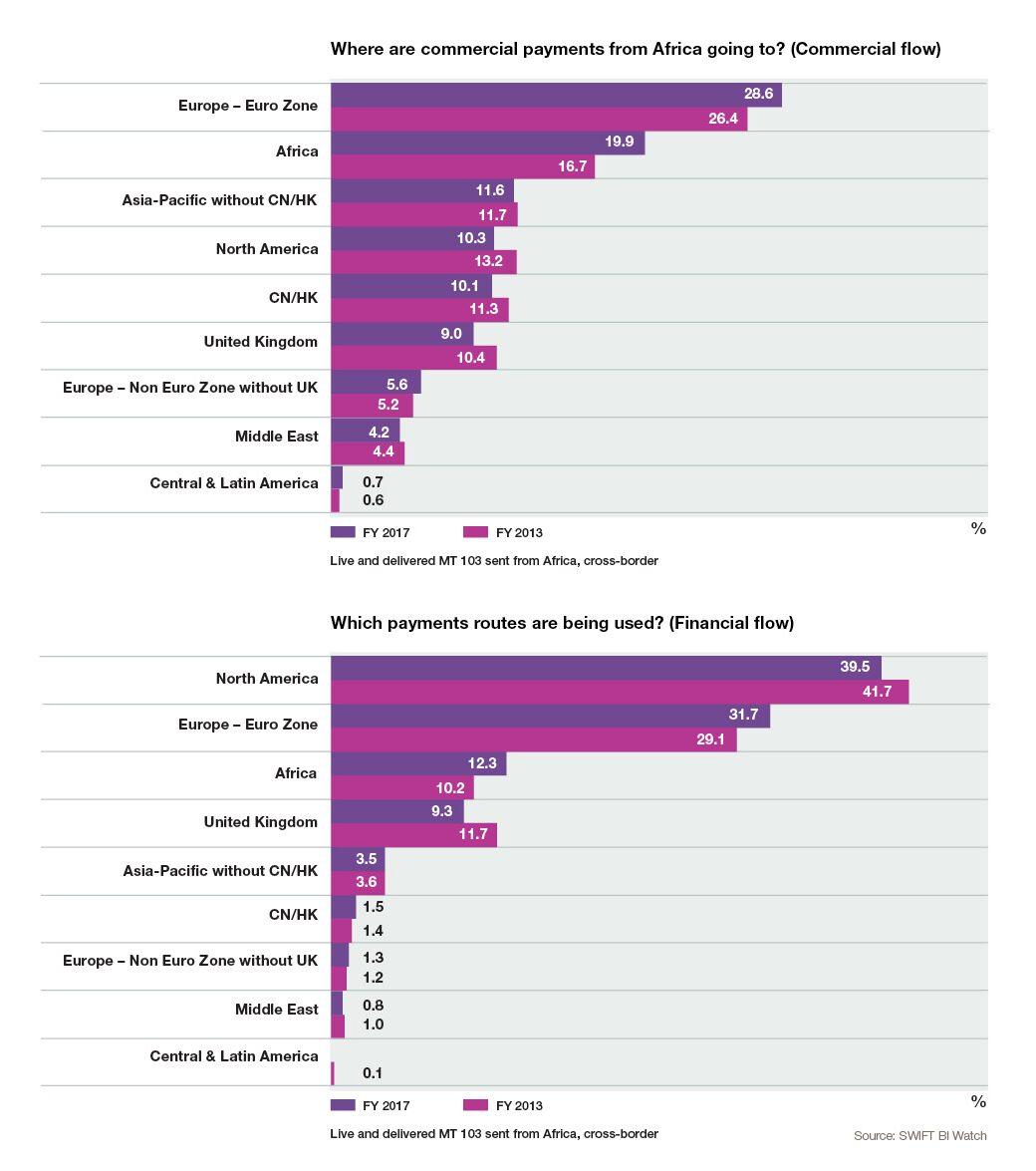

Swift data highlights a significant increase in intra-African commercial payments, with almost 20% of all cross-border commercial payments being credited to an African beneficiary. This indicates that more goods and services are being bought and sold within Africa. This is up from 16.7% in 2013. Intra-African clearing of payments has also increased, from 10.2% in 2013 to 12.3% in 2017. This indicates that an increasing number of payments are being routed through Africa instead of via a clearing bank outside of Africa.

While North America remains the main payment route of financial flows from Africa, its dominance is declining. Banks in North America (mainly the United States) now receive 39.5% of all payments sent by Africa, down from 41.7% in 2013. Use of the US dollar has also decreased as a share of payments originating in Africa from more than 50% in 2013 to 45.1% in 2017.

The use of local currencies such as the West African franc and South African rand is increasing. Use of the franc for cross-border payments has overtaken the rand and the British pound, accounting for 7.3% of payments in 2017, up from 4.4% in 2013. The rand has seen a smaller increase in cross-border payments from 6.3% to 7.2%.

Meanwhile, Europe’s significance as a clearing and trading partner for Africa is increasing. Commercial flows directed to clients based in Europe have increased from 26.4% in 2013 to 28.6% in 2017. In contrast, Swift data suggests that both the British pound and UK clearing banks are losing share of African imports with commercial flows dropping to from 10.4% in 2013 to 9% in 2017 and financial flows from 11.7% to 9.3%. Financial flows do not reflect the magnitude of commercial flows between Africa and the Asia Pacific region. While 21.7% of commercial flows are destined for Asia Pacific, only 5% of financial flows are routed through the region.

Since 2013, almost all African regions have experienced a significant drop in the number of foreign correspondent banking relationships. The Maghreb region has seen the largest reduction, of 47.25%, since 2013, while the East African Community is the only region to see an increase in relationships.

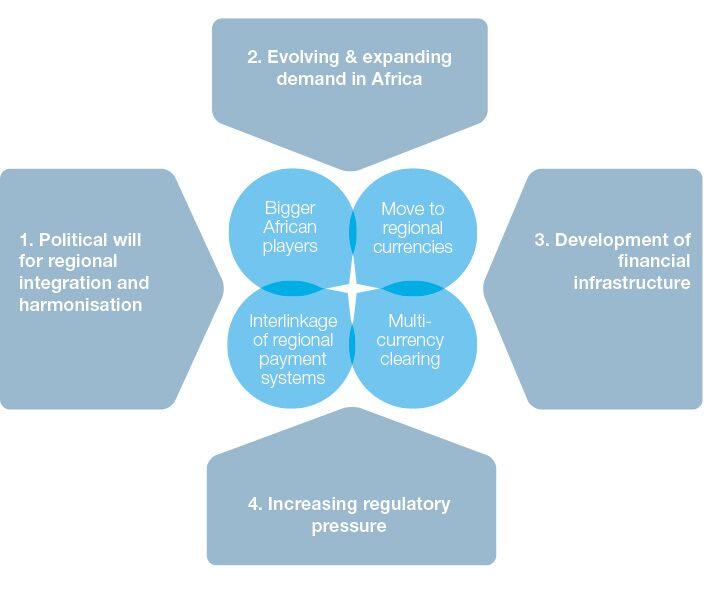

The report also identifies several forces that are driving change in cross-border transaction flows. These are re-shaping cross-border banking in Africa and leading to more intra-African trade.

The report opens with a foreword by the African Development Bank and features contributions from the Bill & Melinda Gates Foundation, the South African Reserve Bank, Ecobank, Standard Chartered Bank and BankservAfrica.