Swift attends the ECB TIPSapp event in Frankfurt

More than 150 delegates from across the European Union attended the European Central Bank’s TIPSapp Challenge event in Frankfurt on 6 February. Sixteen companies presented innovative solutions to initiate and manage instant payments (IP); most solutions focused on the retail consumer market, but some also addressed opportunities in the corporate segment.

The market’s interest for IP and for the Eurosystem’s TIPS platform was clearly demonstrated during the panel discussions that followed the solutions presentations.

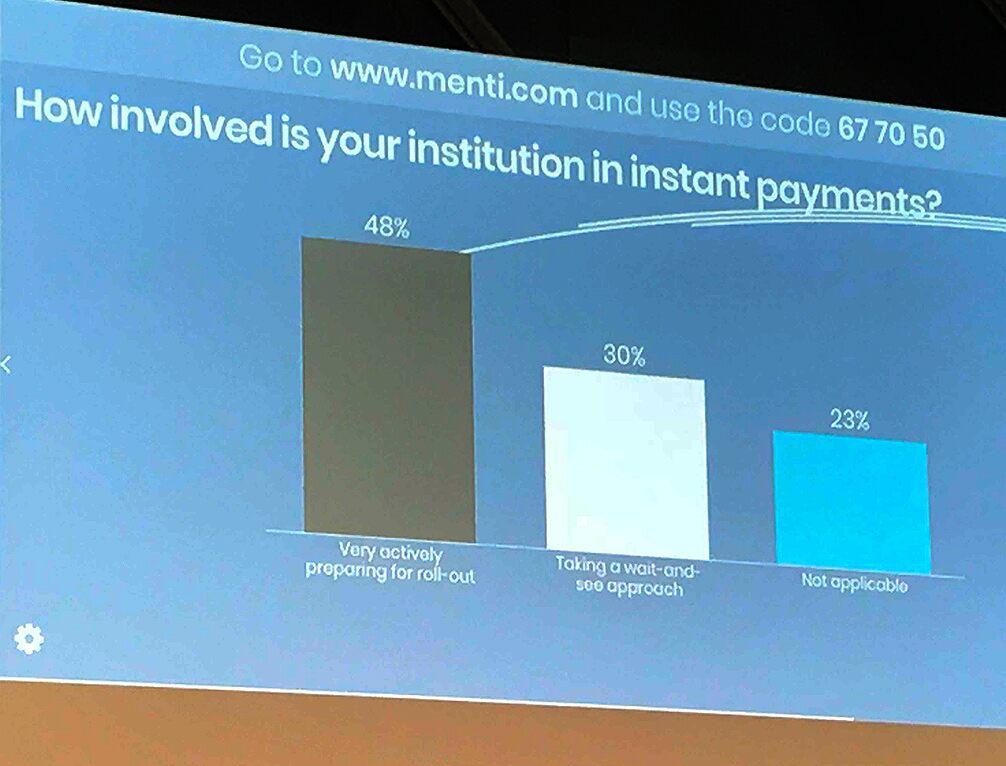

As interest grows in IP across the EU, more banks are preparing to deliver services. During a poll, 61% of the banks in the audience said they are actively preparing for the roll out of IP; 15% of the audience believe IP will be the new norm within one year; 63% expect a take-up in the coming five years; and 21% believe that regulation is necessary to drive IP adoption. Person to person and person to business are seen as the typical first use cases, but corporate customers are already starting to demonstrate interest in some areas.

Other panels debated the key conditions for IP success: convenience, simplicity, value added services – such as returns and direct debits – reach and security. Bank IP services will be driven by community support for IP and interoperability between platforms, seen as a key condition for a competitive market.

In a panel called “Instant payment industry – ready to play?", Isabelle Olivier, Head of Market Infrastructures, EMEA, Swift, said “Instant Payments is one element in a broader evolution of the EU payment landscape that forces all players to review their business model.”

Ms Olivier also re-confirmed Swift’s commitment to support the banking community and Eurosystem market infrastructures, TIPS but also the future Eurosystem Single Market Infrastructure Gateway (ESMIG).

Instant Payments is one element in a broader evolution of the EU payments landscape that forces all players to review their business model.