MT Standards Release 2018 is bigger and has more impact than most MT standards releases

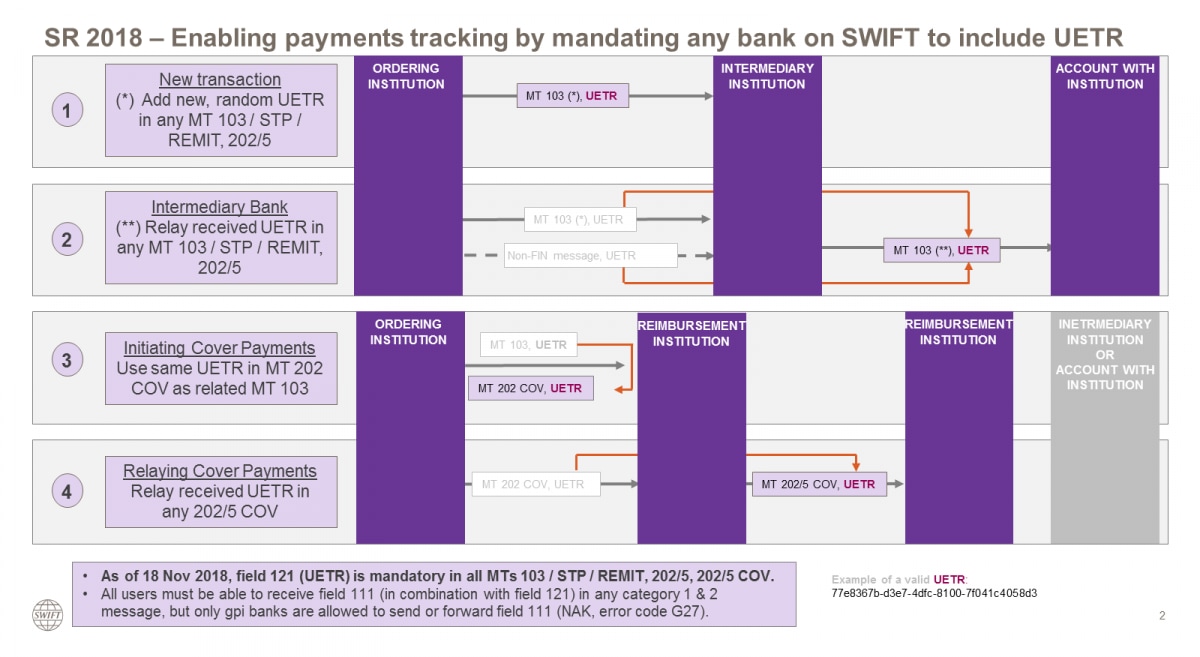

For MT 103, MT 103 REMIT, MT 103 STP, MT 202, MT 202 COV, MT 205 and MT 205 COV, header block 3 will become mandatory and must contain field 121 Unique End-to-end Transaction Reference (UETR) in all messages.

All users of these messages will be impacted, irrespective if they are member of the Swift global payment innovation (Swift GPI) service or not.

In cases where the sender is acting as intermediary and a UETR is present in the received message, the UETR must be passed, unchanged, to the next message in the transaction chain.

In all other cases a new UETR must be used.

The UETR of an MT 202 COV must be the same as the UETR of the underlying customer credit transfer.

For new UETR generation, if the creating application cannot provide field 121 (UETR), then certified FIN interfaces must be able to generate and add a valid random UETR in field 121 in the outbound message.

This change will allow members of the Swift GPI service to track their payments on the Swift network end to end, even if they are being processed by banks that are not part of the Swift GPI Closed User Group (CUG).

Within the Swift global payments innovation (gpi) service, field 121 must be accompanied by field 111. Customers of the Swift GPI service can include field 111 and field 121 in messages where the receiver is not a Swift GPI customer. Institutions that are not senders in the Swift GPI CUG are not allowed to send or forward field 111 and have no processing obligations for field 111. It is nevertheless important to verify that if the header fields are passed to the back-office, all applications are able to receive them. For field 121, institutions that are not senders in the Swift GPI CUG can only send it in MT 103, MT 103 STP, MT 103 REMIT, MT 202, MT 205, MT 202 COV and MT 205 COV.

This change will cover (possible) expansion of the Swift GPI service. Non-gpi banks must therefore be able to receive these fields in all category 1 and category 2 messages.

FIN Inform users and Market Infrastructures using FIN copy have another potential impact in the MT 096 (containing a copy of the message blocks of the original message).

Full details of the changes are on the Standards Release Guide 2018 web page:

- FIN Service Description Advance Information

- FIN Operations Guide Advance Information

- FIN Error Codes Advance Information

- FIN System Messages Advance Information

- SR 2018 Impact on Messaging Interfaces: Mandatory presence of field 121 Unique End-to-end transaction reference (UETR)

In the course of February 2018, Swift Standards organized a series of information sessions. Collateral (recording of the webinar, slides and FAQ document) is available at the following link.

Fore more information on the topic, please contact Swift Support or your sales representative.