Beyond settlement

The wider impact of T+1

Beyond settlement

Compressed timelines reshape corporate actions

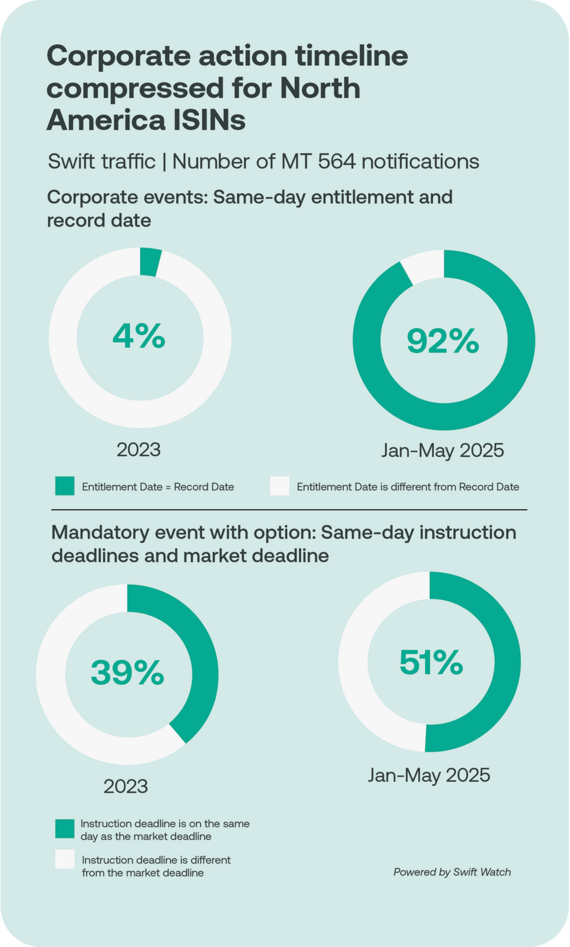

Trade settlements aren’t alone in facing a T+1 transformation, as downstream activities like corporate actions have also been affected.

Our data notes that there has been a decisive shift towards same-day processing of North American International Securities Identification Numbers (ISINs).

In mid-2025, 92% of such events had an entitlement date that matched the record date—a staggering jump from just 4% in 2023.

Previously, there was a one-day buffer between the entitlement and record date, but now real-time reconciliations and instruction readiness between issuers, intermediaries, and investors are the norm.

Instruction handling is also moving towards a sameday cycle. For mandatory events with options involving North American ISINs, the proportion of service provider deadlines aligning with market deadlines rose from 39% in 2023 to 51% in 2025.

A T+1-induced FX transformation

The effects of T+1 are now being observed in FX markets too.

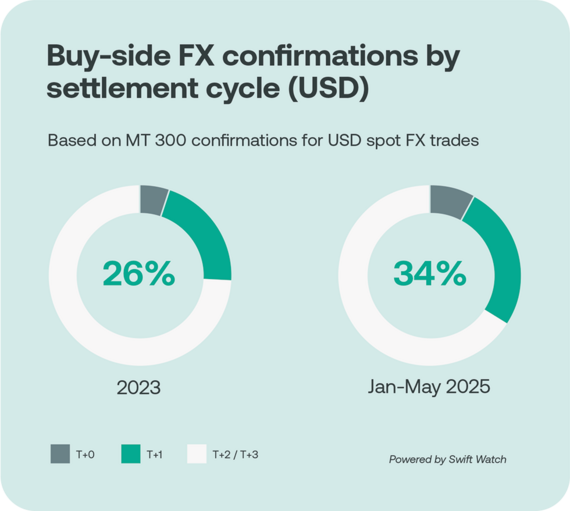

There are some notable differences in FX settlement behaviour post-T+1, according to our MT 300 Spot Transaction data for USD currency pairs.

At buy-side firms – where FX execution is closely tied to securities transactions – the combined volume of T+0 and T+1 FX settlements increased from 26% in 2023 to 34% in mid-2025.

For T+0 transactions, the average deal size – measured by value per MT 300 transaction – fell by roughly 50% after the US adopted T+1. This suggests a move towards smaller, more frequent executions—most likely reflecting the tighter funding cycles and greater need for intraday liquidity flexibility under the new settlement regime.