Integrating payment tracking information in your customer facing channels will significantly enhance your operational efficiency, while equipping your customers with an instant and any time view on their international payments.

Customer expectations around sending and receiving international payments have dramatically shifted in the past few years.

Businesses in the logistics and ecommerce sector have reconceptualised the way goods and services move around the world, delivering an end-to-end experience for senders and receivers. Greater transparency on where goods are means greater certainty for consumers, and cost savings for businesses who can automate many of the customer service requests that come in (e.g. where is my package?).

Increasingly, the question businesses are asking is: if I can track a ten dollar parcel half way around the world, across timezones and borders, why can’t I track my multi-million dollar payment?

Delivering a better experience today

Well, the answer is you can. Today, thousands of financial institutions are using Swift GPI to send hundreds of billions of dollars’ worth of payments every day. And significantly, payments can be tracked by financial institutions from end-to-end, with final confirmation when the funds have been credited to the end beneficiary account.

Operational teams of Swift GPI members can use this information to quickly respond to customer requests such as ‘where is my payment?’ by simply logging in to the Tracker and seeing where the funds are in real-time.

What is ebanking portal integration?

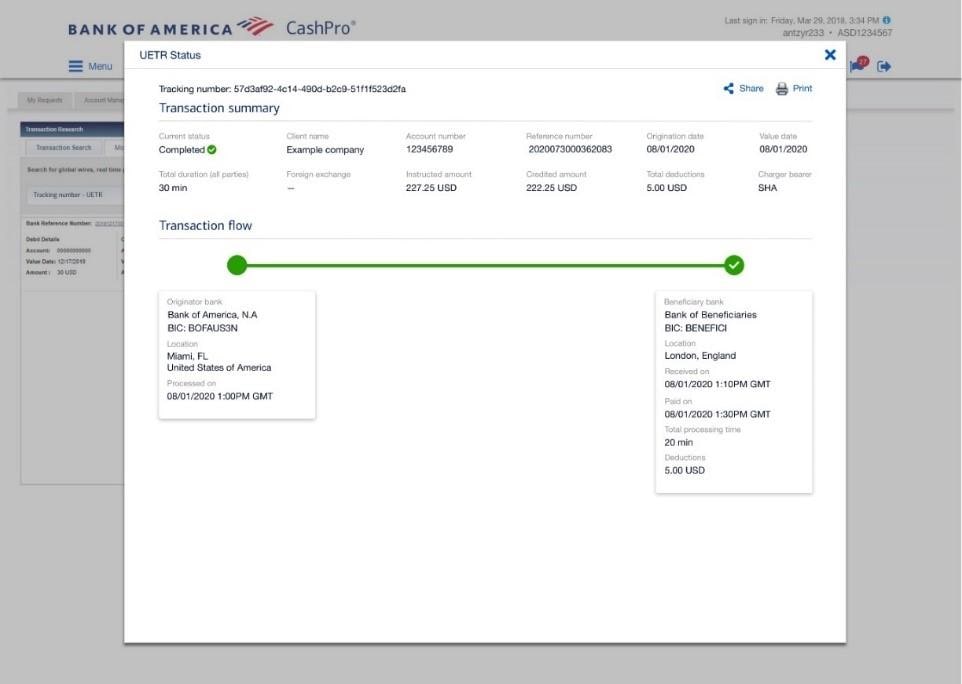

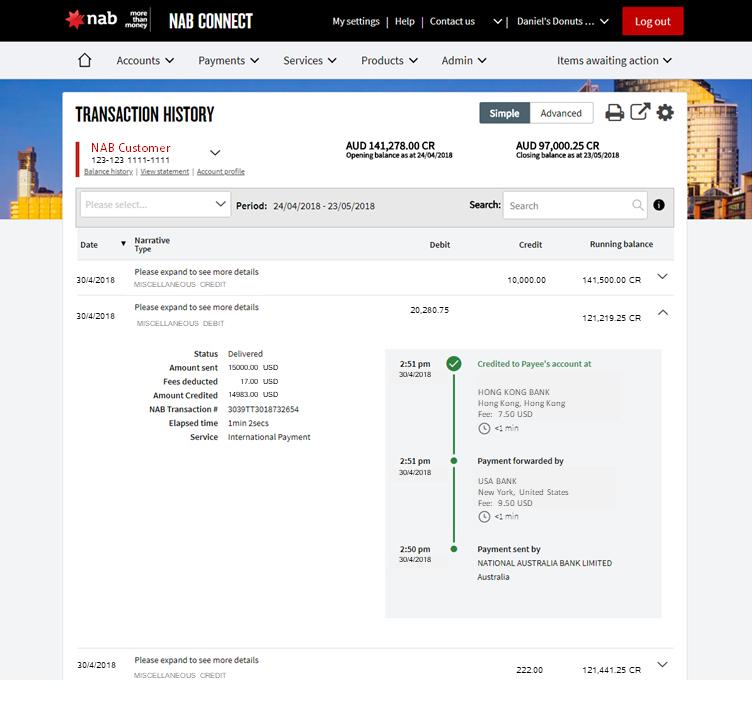

Some financial institutions have taken this a step further, and integrated tracking information directly in their customer facing ebanking portals.

That means their corporate customers are able to log in to their regular ebanking portal or mobile application and get a view of their payments. In the same way you can log in to a courier website to view the status of your parcel, including where it has been previously, this enables customers to check the journey of their payment using the unique identifier of the transaction.

We are pleased to offer our clients Swift GPI data through the CashPro platform. This functionality, which provides clients with visibility into their cross-border wire payments, will help strengthen their operational efficiency by decreasing the need to manually intervene and investigate inquiries,

Depending on your own business preference, you may also include extra value-added information for your customers, including the time elapsed on the payment, and any fees and costs incurred during the transaction. It’s also possible to enable customers to stop their payment in case of error or fraud.

What are the benefits of providing tracking information directly to my clients?

The benefits of integrating tracking information are twofold. Firstly, it enables you to meet your customers’ expectations around cross-border payments. By providing a seamless user experience and greater transparency, it enables you to foster a greater relationship with your customers.

As the first bank in Australia to give customers full access to payment tracking status information for international payments, NAB is committed to improving transparency to build confidence in cross border payments. We know that greater visibility of international payment status is a game changer and provides customers a much better experience at no extra cost.

This could also extend to your customers’ beneficiaries too; some gpi members are now providing end beneficiaries the ability to track inbound payments using UETR tracking information, even if they’re not a customer of the bank (in the same way you can track a parcel from a courier).

On top of integrating the latest gpi functionalities into our e-banking solutions, we want to give our clients an optimal and differentiating digital client experience. This is why innovating together with our clients is so important to us. The idea behind BNP Paribas’s ‘Benetracker’ - born out of our co-creation process with one of our corporate customers - is to go one step beyond in relieving our clients’ burden of dealing with suppliers payment enquiries. Allowing them to proactively offer online payment tracking information to their suppliers directly contributes to the success and growth of their business relationships; and as a bank this is what we’re all about.

Secondly, it enables you to reduce your operational overheads. Financial institutions who’ve integrated tracking information have reported significant drop-offs in inbound support queries (up to a 15% reduction in some cases). This enables your staff to shift their attention from frustrating manual checks on payments to more valuable services.

How do I integrate payments tracking information in my customer facing channels?

To help gpi members get started with their ebanking portal integration project, we’ve created a best practice guide which includes some tips for ways you can run your project. To receive a copy of this document, get in touch with your Swift relationship manager.

To make things even easier, we’ve also developed business APIs to facilitate smoother integration between you and your customers.

You can also hear from UralSib bank about their portal integration journey by downloading our case study.

What if my client banks with multiple banking partners?

For larger customers, the reality of operating on a global level means banking with multiple institutions. To make things simpler for these customers, we’ve introduced a dedicated Swift GPI for corporates service. Using this new standard enables corporates to integrate tracking information directly into their back office (either treasury management or ERP systems), whether they’re using Swift channels, proprietary channels, host-to-host or ebanking portals. That means they can get a global view of their payments, across all their banking partners, in one place.

You can get involved too, visit this page to find out how to offer this service to your clients.