Our case resolution service enables banking operations teams to solve cross-border payment enquiries and investigations faster and easier than ever before.

The way financial institutions and their customers move money internationally has been transformed in the past few years. With tools such as end-to-end tracking, confirmation of credit and clean, unaltered data, inefficiencies are becoming a thing of the past.

But sending money overseas can be complex. There are country and currency specifics as well as regulatory payment obligations to meet, specific formatting to take into account and obviously also human intervention may cause occasional omissions or mistakes. This can result in a payment being held for further investigation in order for it to be processed, otherwise known as an exception.

Being the first US bank to offer gpi case resolution to their clients, BNY Mellon is leading the way in automating payment processes, reducing the costs and time associated with managing payment inquiries. This solution will vastly improve the time to resolve an inquiry, ensuring invoices are paid on time, reducing fraud, and better meeting client expectations. Ultimately, creating straight-through processing for inquiries has been long overdue and will eventually become the global standard.

Reducing friction

Payments can be subject to an exception or investigation for a number of reasons, from the sender missing or incorrectly entering key information such as the debtors name or date of birth, through to regulatory compliance information needed in certain countries.

While the overall number of international payments that are subject to an investigation is very low, the time and effort it takes to investigate and resolve them is not at all.

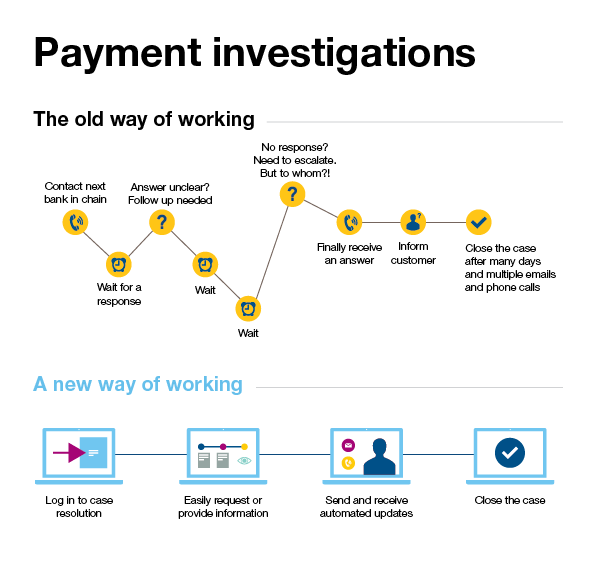

Delays, customer frustrations and costs occur as operations teams investigate by tracking down the funds and contacting the right bank to find what they need. This process is time consuming and labour intensive, often involving multiple back-and-forth emails and phone calls through all parties involved in the entire payment chain before the issue is resolved.

For financial institutions, trying to explain such delays to their end customers can also put a strain on relationships.

What is the gpi case resolution service?

Our new case resolution service, powered by Swift GPI, removes the strain involved in resolving exceptions and investigations. The ‘in-flight’ cloud-based service allows for dynamic query handling between banks on the Swift network, enabling them to quickly resolve instances in which information is incorrect or missing in payment instructions.

We are delighted to be going live with the Case Resolution service and to join the first wave of banks doing so. This represents a significant milestone in both our and the industry’s ambition towards eliminating unnecessary friction and complexity to build a more efficient, dynamic and standardized investigation management platform for banks leveraging gpi, ISO and banking APIs. This industry solution has the scale and reach to help accelerate our goals to offer a more seamless cross border payments and servicing experience for our clients.

What are the benefits of gpi case resolution?

What are the benefits of gpi case resolution?

- Improved transparency: Via the gpi Tracker, financial institutions can follow payment investigation requests anywhere in the cloud and record related interbank communications in an audit trail.

- Shorter resolution time: Financial institutions can smartly route enquiry requests using the Tracker and ensure timely follow up backed by SLAs and a rulebook.

- Reduced manual intervention: Using structured codes in the enquiry exchanges standardises communications. It reduces duplicate inquiries on the same payment and facilitates enquiries’ process automation by case software solutions.

Exceptions and investigations remain a significant pain point for any bank involved in correspondent banking, mainly due to the use of free format messages that require manual handling. This new case resolution service goes a long way towards improving the whole process, helping to solve them seamlessly and thereby, make our payment business even more efficient and smooth.

How does gpi case resolution work?

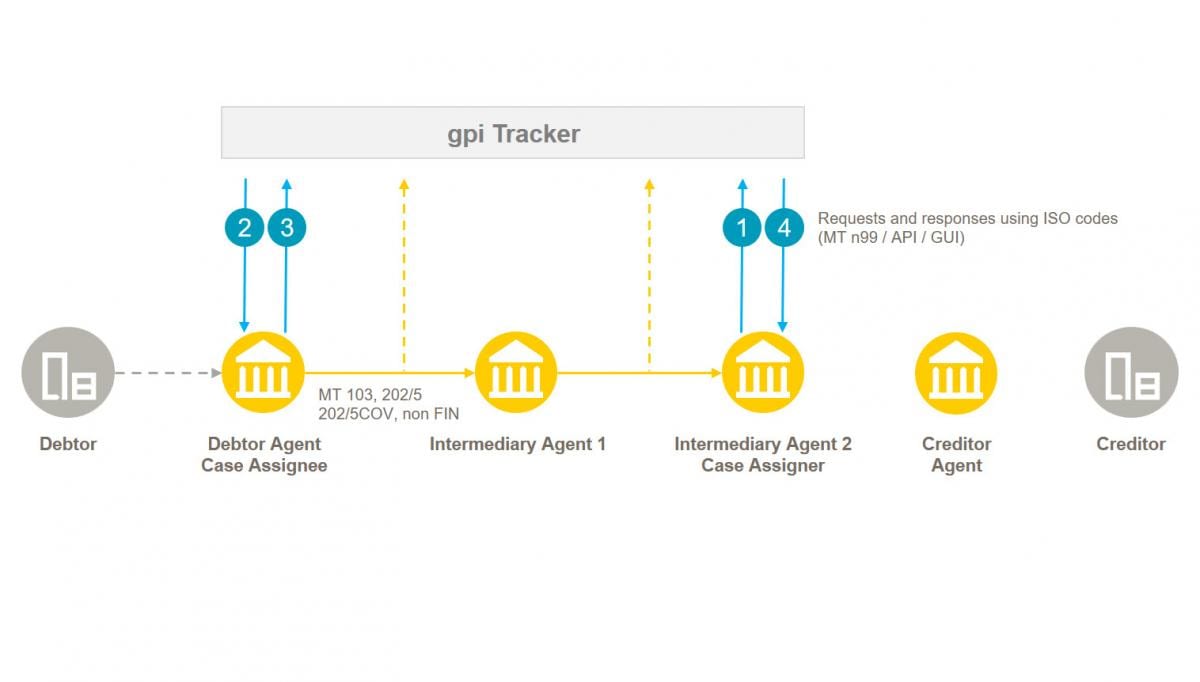

Payment investigation requests are routed via the Tracker directly to the financial institution closest to the ordering customer, who will provide a response within a predefined timeframe.

Case resolution requests and interactions with the Tracker are done via API, MT n99 or GUI.

Requests and responses make use of standardised ISO 20022-based codes to allow automated routing and drive process automation.

When can I sign up to gpi case resolution?

Our case resolution service is now live and gpi members can sign up today. A community of 72 financial institutions have already joined the service as early adopters, along with six application providers.

A community solution for JapanA group of 60 financial institutions in Japan have signed up to gpi case resolution, marking a first major country-wide implementation of the new solution.

The group of financial institutions opted for a community-based adoption to maximise efficiency. By leveraging our new front-end GUI, the financial institutions are able to deliver new value-added services leveraging their existing Swift connectivity, without significant additional investment.

Doing so will enable the banks to provide a more streamlined service level with other correspondents in the world, fostering better relationships with their counterparts. |

How do I get started with gpi case resolution?

If you’d like to get started with case resolution, you can either contact your Swift relationship manager, or you can place an e-order through your MySwift profile on swift.com.

Combining the power of the gpi Tracker to solve an industry challenge such as investigation handling is a great innovation and we are delighted to be one of the first banks to embrace this service. Ultimately it’s the end customer who benefits, as more banks embrace the service, payments will become even more frictionless.

What if I’m not a Swift GPI member?

At present, case resolution is a service exclusively for Swift GPI members. However, we intend to bring the benefits of smooth and frictionless case resolution to our entire community.

This new service will extend the benefits of centralised case management to all Swift financial institutions, meaning the end of bank-to-bank sequential information exchange.

We’re proud to be the first bank in the world to go live with the gpi case resolution service. With greater transparency into investigations, we can provide our clients much greater visibility into the status of their payments, giving them peace of mind and avoiding frustrating back and forth communication chains.

Pilot participants

|

AlfaBank Goldman Sachs HSBC |

Industrial and Commercial Bank of China Intesa SanPaolo |

Participating application providers Appian Expertus Pega SmartStream Syracom Virtusa |

Order gpi Case Resolution