The industry has a lot to gain from transforming the way it processes exceptions and investigations (E&I). Through in-depth research with our community, we’ve quantified this huge opportunity and demonstrated how our enhanced Case Management solution can help achieve it.

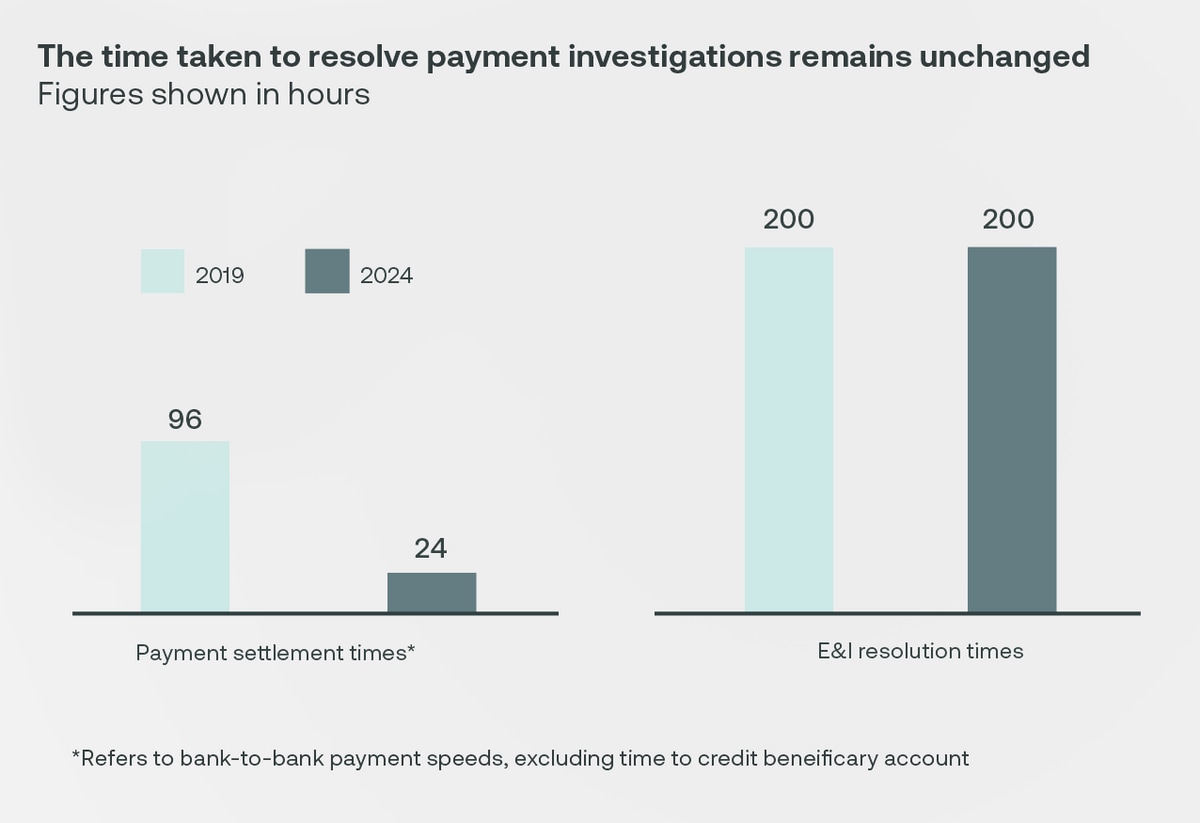

In recent years, the speed of cross-border payments has rapidly increased, making progress towards the G20 targets, supporting global businesses, and facilitating the smooth flow of funds for consumers too. Data from Swift’s network shows that 90% of transactions now reach end banks within just one hour.

But while payment settlement times are a quarter of what they were five years ago, exceptions and investigations (E&I) continue to present a significant challenge. This is true for both banks and corporates and affects numerous networks and technologies.

Quantifying the E&I opportunity

To help the financial industry overcome this challenge, we’ve greatly enhanced our Case Management solution. Built on a foundation of ISO 20022, this network-agnostic solution leverages the standard’s richer, more structured data to streamline payment investigations when things don’t go to plan. By harnessing the industry-wide unique end-to-end transaction reference (UETR), this solution could help streamline E&I processes across any network that uses it. In addition, the solution harnesses features such as smart routing, automated reminders and responses, and end-to-end tracking to help institutions save time and money when processing investigations, allowing them to concentrate on tasks that bring more value to their business.

And now, through in-depth research with 30 financial institutions, we’ve quantified just how much the industry stands to gain by adopting Case Management. Participants in our research were banks of varying sizes, as well as global corporates. They shared their experiences with the current state of E&I, along with data to help quantify what a lack of efficiency is currently costing the industry.

It’s time to transform exceptions and investigations

Read our paper to find out how much the industry can save by transforming E&I.

The true cost of E&I

Payment investigations cost the industry a huge amount every year, with some banks spending as much as $20 million on fees and penalties for delayed settlements. Our research found that early adoption of Case Management could help the financial industry save over $600 million annually on operational and liquidity costs, and could also boost gross revenue by 3-5% as a result of increased market share. Additionally, the average time to complete investigations could decrease by up to 80%.

It's time to transform E&I

The E&I transformation starts today. By raising the standard of E&I processes across our industry, we can improve customer experiences, reduce costs, and increase efficiency. So that even when payments don’t go to plan, issues are quickly resolved to keep money moving—whichever network they travel over.

“Inefficient investigations processes are impacting the industry greatly in terms of cost and time and drastically affecting the customer experience,” said Shirish Wadivkar, Global Head of Transaction Management at Swift. “Our enhanced solution addresses the main pain points in investigating incidents, helping our community make gains in efficiency, time, and costs to provide the experience that customers expect. It’s not only a great example of how the ISO 20022 standard can help our industry deliver better user experience by removing friction and providing transparency, but is also a case in point as to how Swift is committed to interoperating an increasingly complex financial ecosystem by extending the benefits of our solutions across networks.”

Get started with Case Management

To learn more about Case Management or start your adoption journey, reach out to your Swift account manager or get in touch.

Related

Swift at Sibos - A new era of exception management: Smart, fast and efficient

While the industry has transformed payments over the last decade, exception and investigation management is still catching up.

When friction occurs, costs and end-customer satisfaction are negatively impacted due to slow and inefficient processes. ISO 20022 and centralised case management orchestration represent a unique opportunity for the industry to modernise investigation processes, maximise efficiency and drastically reduce costs.

Watch this session to discover how we’re making this vision a reality and how your peers are assessing the value.