What is changing?

Eurosystem changes

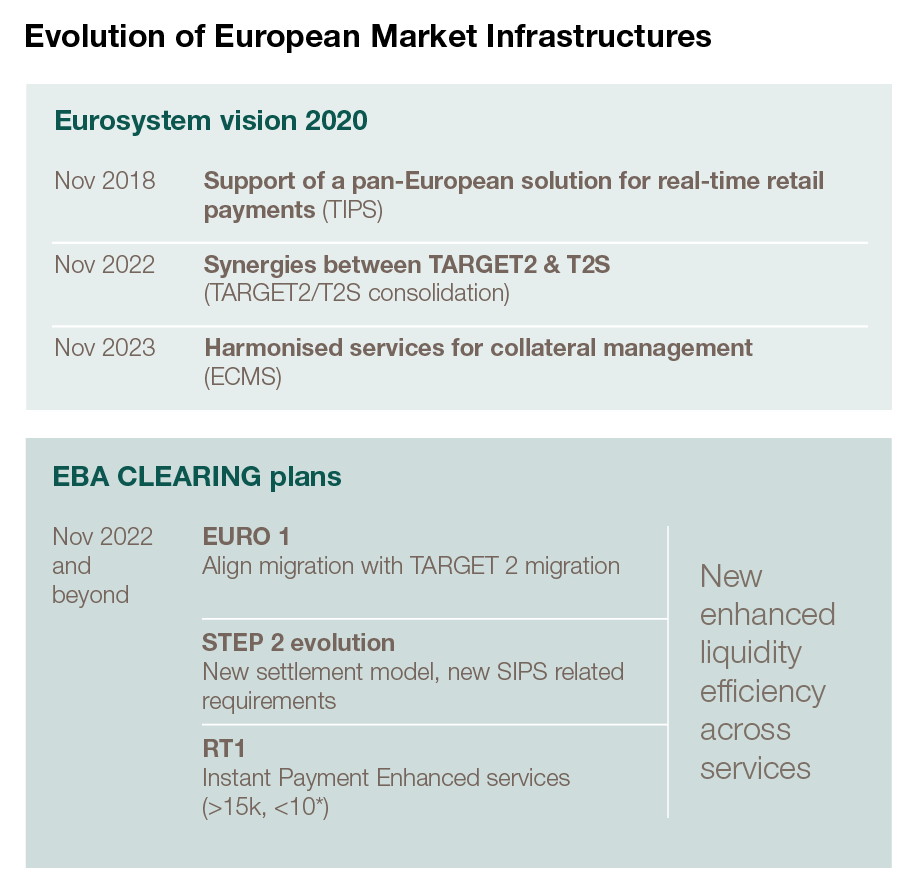

The Eurosystem’s TARGET Services include TARGET2 (the real-time gross settlement (RTGS) system for settling payments), T2S (the securities settlement platform) and TIPS (the service for instant payments settlement). All of them settle in central bank money.

TARGET consolidation is a project launched by the Eurosystem to consolidate TARGET2 and T2S, in terms of both technical and functional aspects. The objective is to meet changing market demands by replacing TARGET2 with a new real-time gross settlement (RTGS) system and optimising liquidity management across all TARGET Services. The new RTGS system will offer the market enhanced and modernised services. TARGET2 will migrate to ISO 20022 messaging (T2S and TIPS already use ISO 20022 messages).

This will be a “big bang” migration, scheduled for November 2022.

The Eurosystem will introduce a number of other components that will be shared across all TARGET Services:

- A harmonised interface – the Eurosystem single market infrastructure gateway (ESMIG) – will make it easier for participants to access and use the Eurosystem's services from a single entry point.

- Common reference data will reduce the effort required to create and maintain multiple copies of reference data and will centralise the management of user access rights.

- A common data warehouse will make it possible for participants to access historic information.

- A common billing system will help the Eurosystem optimise its operational costs.

EBA CLEARING changes

EBA CLEARING has also announced changes to its euro payment systems.

The EURO1 high value payment system will also migrate to a V-shape full ISO 20022 model in the same timeframe as TARGET2 and as closely aligned with TARGET2 as possible so as to ensure continued interoperability between the two systems. Swift will continue to be the only Network Service Provider for EURO1.

A new settlement model will be introduced for STEP2, the main pan-European batch low value payments (SEPA ACH), and investment will continue in RT1, EBA CLEARING’s pan-European Instant Payment platform.

A new central liquidity dashboard will provide real-time view on liquidity limits and balances across EBA CLEARING’s different services.