Our story

For over 50 years, we’ve kept global economies turning. Learn how it all began—and what’s still to come.

Our story

1973: The year it all began

239 ambitious banks, 15 countries, and one shared vision: to transform the way value travels across borders. Telex’s time was up, as the founding banks formed a cooperative utility and Swift was born.

1977: Swift goes live

Swift’s formation was turning heads. And by the time we went live in 1977, the number of institutions in our community had nearly doubled as word spread around the globe. 518 institutions from 22 countries were connected to our messaging service, which put efficiency, security and reliability at its core. The following year, 1978, we’d host the very first Sibos conference in Brussels, Belgium.

1980s: The community grows

The start of the ‘80s marked yet more progress, with Hong Kong and Singapore starting live operations. In 1983, the first central banks connected to Swift, reinforcing our role as the common link within the financial industry. 1987 saw our entrance to the securities market and the launch of our first value-added services. By the end of the decade our community had grown to over 2,800 institutions sending nearly 300 million messages a year.

1990s: A decade of innovation

By the late ‘80s, institutions were sending 300 million messages a year. But that number didn’t stay impressive for long—just a few years later, they were sending the same amount every single day. The ‘90s were a decade of innovation, and in 1991 Swift was recognised with the Computerworld Smithsonian Information Technology Award for transforming financial communication.

Soon after, Interbank File Transfer went live, and as the decade closed, our FIN availability rate hit an industry-leading 99.98%. As the euro approached and Y2K loomed, we weren’t just prepared—we were leading the way.

2000s: Into the billions

Swift had become the backbone of the global economy. In just a decade, millions of messages turned to billions—3.76 billion a year between 9,000 institutions and 200 countries and territories. As technology advanced, we did too, launching even more innovative products to give institutions new ways of connecting to Swift, keep them safe from cyberattacks, and deliver them an efficient and predictable service.

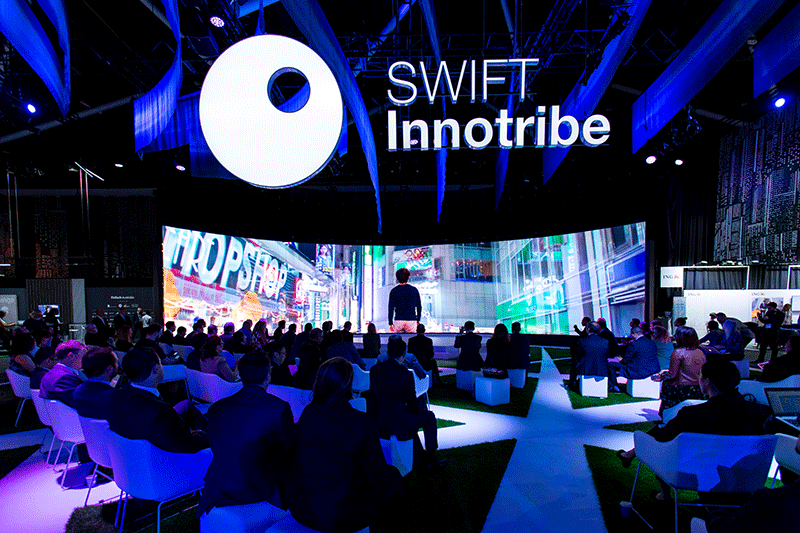

We introduced SwiftNet, launched Innotribe, led the financial industry’s migration to ISO 15022, and deployed ISO 20022. To close the decade, we entered regional integration projects like SEPA and TARGET2 in Europe.

2010s: The birth of Swift GPI

Throughout the 2010s, companies began placing increased importance on offering their customers the best experience possible. This included the ability to track orders in real time, and it wasn’t long before financial institutions wanted the same experience when sending cross-border transactions too. Against this backdrop and in a watershed moment, Swift GPI was born, offering real-time tracking for transactions from initiation to delivery.

With technology advancing and cybersecurity taking centre stage, we launched the Customer Security Programme to enhance fraud protection and ensure every member of the community’s defences are watertight. As the decade came to a close, we announced a phased global migration to ISO 20022 that would transform financial messaging through the standard’s richer, more structured data.

2020s: Just the beginning

Though far from over, this decade has already seen remarkable progress. The ISO 20022 migration is well underway, with live traffic already flowing across our network every day. In 2024, Sibos made its debut in Beijing, marking a milestone year that also saw successful live trials of digital currency and asset transactions, the result of extensive collaboration across the industry. And, as AI continues to evolve, we’re exploring how it can detect anomalies and protect funds from fraudsters, adding another layer of security to global transactions.

Alongside our community, we’re driven by a shared vision for a brighter financial future—and we’re not alone. The G20 has set ambitious targets to enhance the speed, transparency, cost, and accessibility of cross-border payments by 2027. We’ve already made significant strides towards achieving these, and through continued work with our community we’ll continue doing so throughout this decade—and for many more to come.