Why we're migrating

A global and open standard, ISO 20022 creates a common language for payments worldwide. And its higher quality data means better payments for all. ISO 20022 adoption is also the opportunity to improve customers’ experience with richer information to ease invoices reconciliation, reduce manual intervention to correct or investigate payments with structured data or support customers profiling with better data analysis on the nature of payments processing. Native adoption of ISO 20022 will have vast implications across your payments value chain. If not done yet, it is time to plan your journey.

[Ebook] Supercharge your payments business with ISO 20022

Leading financial institutions share insights on the concrete benefits opened up by ISO 20022’s rich, structured data capabilities.

Industry decision to migrate

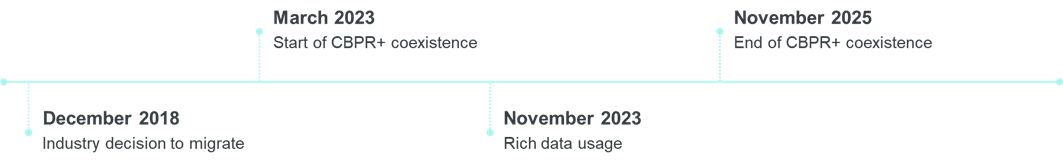

In 2018 the Swift community decided to adopt ISO 20022 for cross-border payments and reporting. With the new standard used in over 70 countries, and forecast to be used in 80% of clearing and settlement of high-value payments by 2025, financial institutions gave Swift the mandate to facilitate the move to this new language of payments.

Start of coexistence

March 2023 marked the start of the migration to ISO 20022 (MX), with a coexistence period with MT messages until November 2025. Financial institutions can migrate at their own pace, relying on central In-flow translation, or local translation services, until their back office is natively ready to process ISO messages.

From March 2023, any bank can start sending MX messages, independently of their correspondent’s preferred channel (MT or MX).

Rich data usage

From November 2023, the PMPG encourages the community to start sending rich data elements for cross-border payments and leveraging the full potential of ISO 20022. Swift supports the PMPG guidance from this group of experts.

If rich data is part of a transaction and cannot be passed on with full data integrity, the Market Practice for Data Integrity from the CBPR+ working group provides guidance on the roles and responsibilities for reporting missing or truncated information.

To support banks’ implementation of this Market Practice, we’ve developed a ‘Rich Data Access’ feature as an enhancement of our Case Management solution and made it universally available to all users that may require access to rich ISO 20022 data.

End of coexistence

In November 2025, cross-border payments and reporting traffic shall have migrated to the ISO 20022 format and Categories 1, 2 and 9 of MT messages will be retired. That will mark the end of the co-existence period.

By then at the latest, financial institutions must natively adopt ISO 20022 and CBPR+.