Make your customers smile

How much can you send over Swift Go?

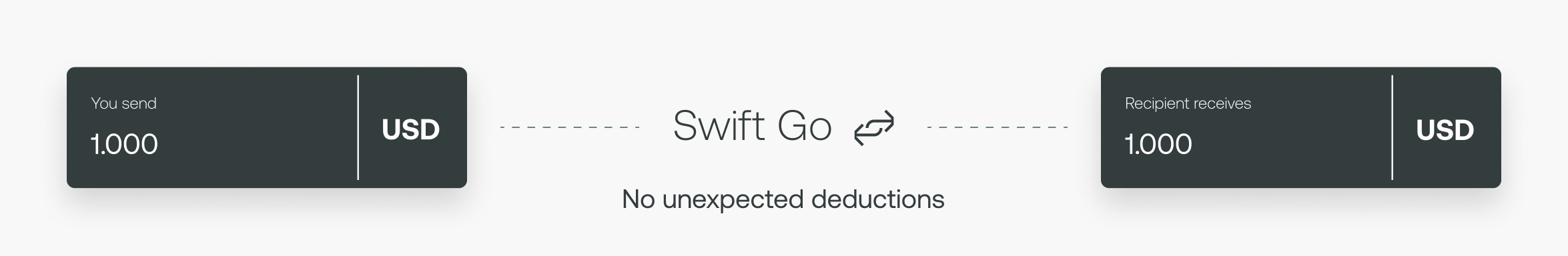

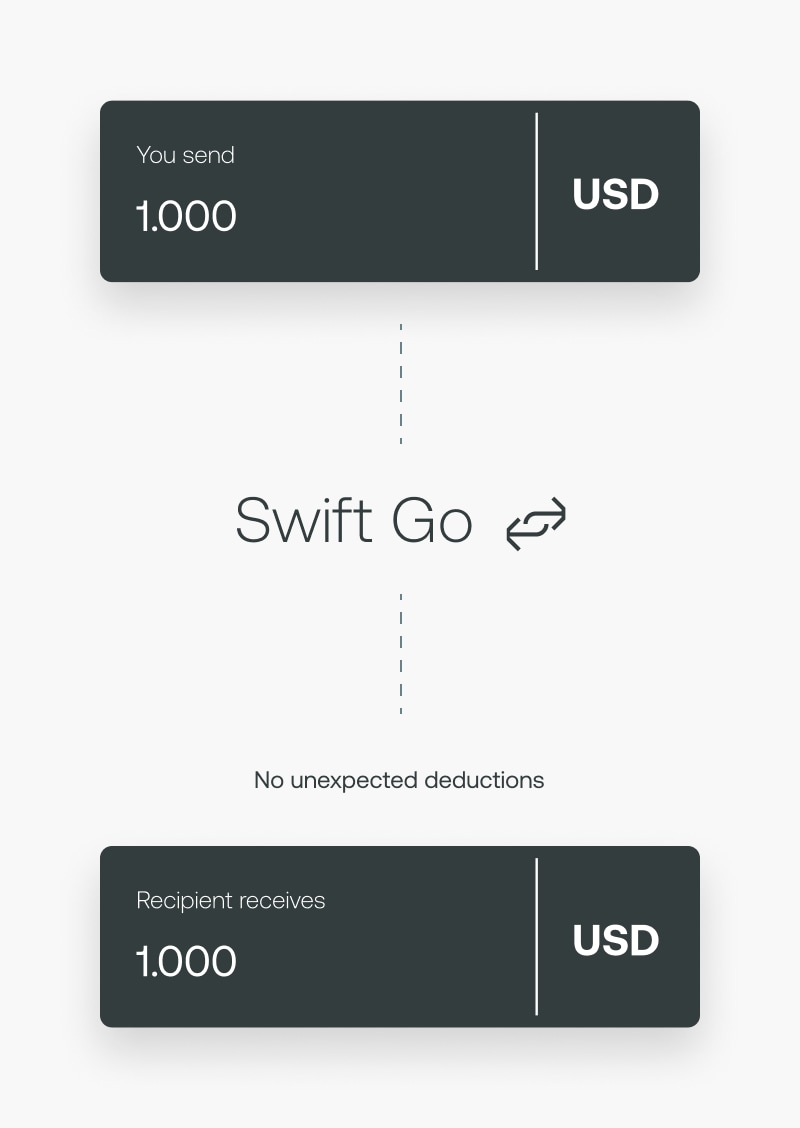

No deductions

Our ‘no deduct’ principle makes sure that the full amount is always credited to the recipient.

SLAs we can all agree on

Sending money with Swift Go is simple, and that’s all thanks to our service level agreements (SLAs). When you sign up, you’ll need to agree to process all payments in under four hours and promise not to make any extra deductions.

We make payments predictable

Your customers can send money straight from their bank accounts and rest assured it will arrive on time and in one piece. If you’re a Swift GPI customer, let your customers track their transfer by integrating payment tracking into your banking app.

An award-winning solution

Having taken home the trophy for Best Industry Innovation at The Card and Payment Awards 2023, we’re excited for what the future holds for Swift Go.

Ready to get started?

Learn how to get set upMoving finance forward

As a trusted industry cooperative, we’ll help you grow from strength to strength. We’re not after your customers, business or money – just our vision for a frictionless financial future.

When you choose Swift Go, you also choose a secure, best-in-class network that’s trusted by 11,500 institutions worldwide. Keep your customers’ money safe and don’t compromise on security.

We’ll take care of the back end so that you can concentrate on developing a seamless payments experience for your customers. Now that’s what we call teamwork.

Payment Pre-validation: Swift Go’s perfect partner

Check all payments for errors upfront with Payment Pre-validation – a solution that works seamlessly alongside Swift Go. Learn how this API-based solution could help remove friction from your payments process.

Learn more Learn more

Speak to a Swift Go expert

Still got questions? Reach out to a member of our team and get the answers you need.

Get in touch