Universal payment confirmations

Being able to track and confirm payments in real-time is fundamental in the world of modern commerce. All banks in a payments chain need to work together to bring this to reality.

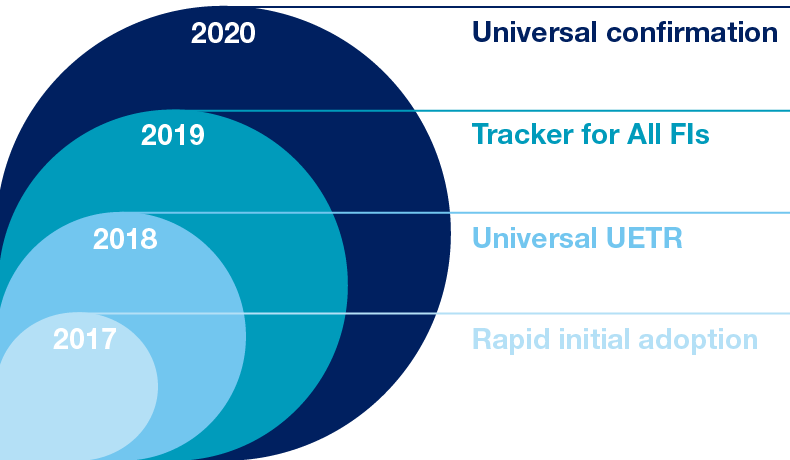

We took the first step towards achieving this through Swift GPI in 2018, with the introduction of the Unique End-to-End Transaction Reference (UETR) for all payments.

The UETR enables full end-to-end tracking of all cross-border payments on the Swift network.

With Universal Confirmations, the ordering customer of a payment knows at any moment where is the payment and when the final beneficiary has been credited.

Payment confirmations - confirmation funds have hit the beneficiary account - are now the next crucial piece in the puzzle.

That’s why, by end 2020, it will be mandatory for all financial institutions receiving payments (MT 103 messages) to confirm when a payment has been credited to the account of the beneficiary.

Why are payment confirmations crucial?

End-to-end tracking and confirmation of credit are essential for two reasons:

- They enable financial institutions to provide an enhanced experience to customers

- They are the building blocks for developing future payment services

Customers today expect to be able to track all their payments from end to end, and know with certainty when the funds have reached the end recipient’s account. This becomes all the more important for critical payments.

What’s more, business processes and supply chains increasingly rely on payment confirmations: without it, sellers may not release the goods.

We are also developing future Swift GPI services based on the ability to track and confirm payments. And these same capabilities enable financial institutions to build their own value-added services for their customers on top of gpi.