Streamline and automate your exception management processes

Sending money overseas can be complex. There are country, currency and regulatory-specific payment obligations to meet, particular formatting to take into account and the possible need for human intervention due to omissions or errors. This can result in a payment being held for further investigation before it can be processed, otherwise known as an exception, which can take a considerable amount of time and effort to be resolved.

Using our ‘in-flight’, cloud-based case resolution service, users can easily handle queries between banks on the Swift network and resolve instances when payment information is incorrect or missing.

Case resolution is now an integral part of our standard exceptions and investigations procedure… The total timeframe of investigation becomes 3-5 days shorter and the payee gets the money sooner.

How does it work?

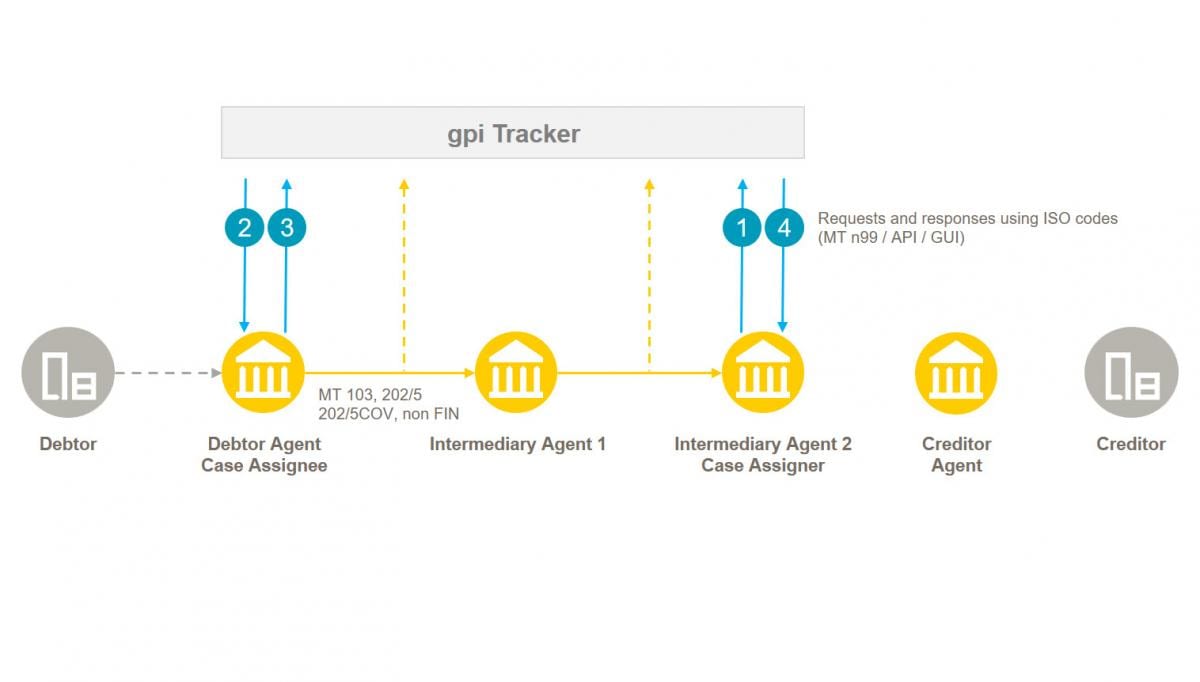

Case resolution offers improved transparency via the Tracker, enabling you to follow enquiry requests anywhere in the transaction journey and record related interbank communications in an audit trail.

This innovative service significantly shortens resolution times, smartly routing enquiry requests to the right agent to ensure a timely follow-up. It also drastically reduces manual intervention, utilising an ISO 20022-based format and structured codes to standardise communications and avoid duplicate enquiries on the same payment.

The service can be used via FIN, Tracker GUI and API.

Centrally access ISO 20022 rich data with the Case Resolution Rich Data Access feature

This new feature facilitates banks’ implementation of the CBPR+ Data Integrity Market Practice Guidance, providing users with central and instant access to rich data in cases where a transaction's format is downgraded from ISO 20022 to MT.

The Rich Data Access feature is universally available to all Swift users requiring access to ISO 20022’s rich data. It’s available for free – with no subscription or onboarding required. You can easily access this functionality through the Swift GPI and Basic Tracker Graphical User Interface (GUI).

Want to know more about this exciting new capability? Please refer to the below documents:

- Rich Data Access Feature Overview – explaining, in simple terms, what the Rich Data Access feature is.

- Rich Data Access Feature walkthrough – a comprehensive document outlining how you can benefit from this universal capability.

Values & benefits

Improved transparency

Via the Tracker, you can follow case requests anywhere in the cloud and record related interbank communications in an audit trail.

Shorter resolution time

Financial institutions can smartly route enquiry requests to case resolution using the Tracker, and ensure timely follow up backed by SLAs and the rulebook.

Reduced manual intervention

Use structured codes to standardise communications, reduce duplicate inquiries on the same payment and facilitate enquiries’ process automation by case software solutions.

How can I sign up?

For gpi members

Our case resolution service is now live - gpi customers can sign up today. A community of over 100 financial institutions have already joined the service, along with six application providers.

Follow the ordering process, contact your Swift account manager or get in touch with our sales representatives.

For non-gpi members

Non-gpi banks subscribing to this service will have access to our Case Management portfolio, including both Case Resolution and Stop & Recall.

Have a question?

To learn more, check out our FAQs or get in touch with your account manager.

Or, explore our Stop & Recall case management service.

Get started with Case Resolution today

Place your order now.