Cross-border payments, transformed

In today’s digital world, when you make a cross-border payment you expect the service to be delivered at the touch of a button. Yet, in reality, cross-border payments can take days, can’t be tracked, there’s a lack of transparency on fees and remittance data can get altered in the process.

Today, Swift GPI is transforming the cross-border payment experience entirely, by:

- Enabling you to credit your end beneficiary in minutes or even seconds;

- Allowing you to track your payment from end-to-end, like a parcel;

- Offering you transparency on exactly what fees you will be charged;

- Ensuring that the remittance data remains unaltered when your payment arrives.

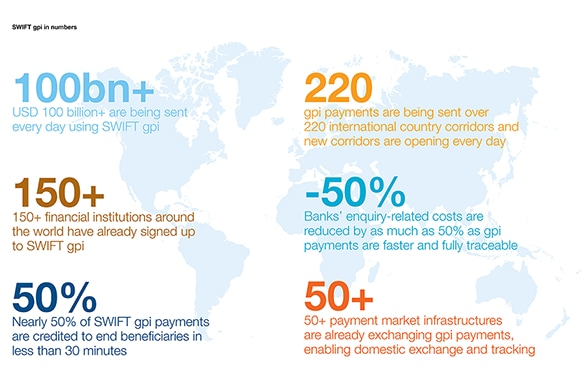

Swift GPI has already been adopted by more than 150 banks around the world and more than 100 billion USD in Swift GPI messages are being sent every day – enabling payments to be credited to end beneficiaries within minutes or seconds. Swift GPI payments now represent nearly 10% of Swift’s cross-border payments traffic, sent daily across 220 international payment corridors.

Swift GPI is set to be the standard for all cross-border payments by the end of 2020.

Value for gpi banks

Swift GPI enables banks to:

- Offer their corporate customers a transformed cross-border payment experience;

- Reduce their payment enquiry costs by as much as 50%;

- Better manage and optimize their liquidity;

- Enhance their international payments offer by developing their own services on top of gpi.

Value for corporates

Swift GPI enables bank’s corporate customers to:

- Pay for international goods and services in a fraction of the time;

- Shorten their supply cycles and reduce their exposure to FX risks;

- Receive a real-time, end-to-end view of their cross-border payments;

- Improve their cash forecasting and optimize their liquidity;

- Receive a confirmation notice when the money reaches the recipient’s account.

Meeting the needs of corporate treasurers

Corporates looking for same-day value, pricing transparency, end-to-end tracking across their cross-border payments, can now rely on the Swift GPI Customer Credit Transfer service.

Delivering the digital transformation of cross-border payments

In collaboration with banks and corporates around the world we are developing additional payments services, including rich remittance transfer, a stop and recall payment service and more.

Exploring technological innovation in cross-border payments

Exploring the potential for using new technologies in the payment process, including a Proof of Concept to see if distributed ledger technology could help banks reconcile their nostro accounts in real time.

Be part of Swift GPI as a corporate

As a corporate, you can endorse the transformation of cross-border payments.