ISO 20022 CBPR+ compliance for third-party providers

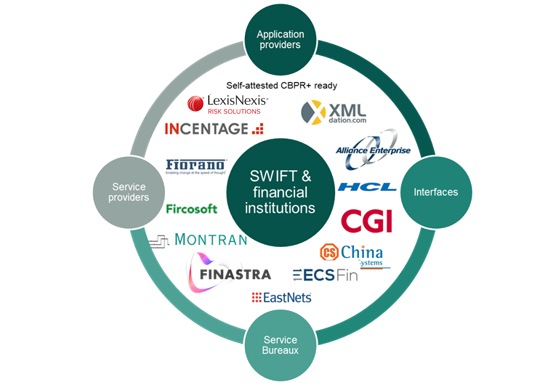

Swift’s Partner Programme helps customers make well-informed purchasing and implementation decisions, and providers differentiate their offerings in a thriving marketplace. You can find all the information you need on how to join here: Swift’s Partner Programme.

Swift is working closely with the partner community to provide access to necessary information, specifications, tools and test services to support our customers in their drive to adopt ISO 20022, on-time and to the right standard.

Which partners are CBPR+ ready?

Access the list of partners that have confirmed and shared their commitment to support the CBPR+ message collection, in addition to equivalent MTs.

Timelines

In March 2023, acting on feedback from the community, Swift enabled ISO 20022 messages for cross-border payments and cash reporting (CBPR+) businesses.

November 2025, marks the moment when MT categories 1, 2, and 9 will be decommissioned on FIN, and the final date to enable full ISO 20022 for cross-border payments.

Usage guidelines, the Vendor Readiness Portal and self-attestation

Partners may download the Cross-Border Payments and Reporting Plus (CBPR+) usage guidelines and test compliance using the Vendor Readiness Portal (CBPR+ SR2023 Combined) or the Enterprise Testing Solution for Swift partners.

In order to become ISO 20022 CBPR+ ready perform the following steps:

- Request access to the Vendor Readiness Portal community via MyStandards or via e-mail

.

. - Test against supported message types published on the Vendor Readiness Portal (CBPR+ SR2023 Combined)

- Fill in the self-attestation form and send it to provider.readiness@swift.com

The verification process can take several business days after which you will be informed about its outcomes.

The list of partner applications that have self-attested as “ISO 20022 CBPR+ Ready” has been published and will be updated monthly, to enable financial institutions to make informed choices when making purchasing decisions.

Complete and submit the self-attestation form

We publish and update the partners and products that have passed our CBPR+ readiness tests. Apply using the self-attestation form.

Enterprise Testing Solution for Swift Partners

The Enterprise Testing Solution (ETS) provides a stable and rich environment for Swift partners to test and qualify their products against our messaging and cloud services. The ITB environment – see below – simulates message flows, while ETS allows for true end-to-end message flow testing, which is an important improvement for CBPR+.

The ETS is currently available to partners who:

- Have a payments application (back-end, core banking, etc.)

- Are supporting clients on-board gpi services

- Are providing on-boarding to Swift Business Connect product

Swift partners can reach out to provider.readiness@swift.com to register their interest and apply for testing access.

Integration Test Bed (ITB)

Swift provides the swift.finplus!xpf service on the Integration TestBed (ITB). Registered Providers can find information on the FINplus service and instructions on how to subscribe by following this link to FINplus ordering on Swift.com. A ‘knowledge tip’ has been created to give more detail to both banks and partners.

In addition, Registered Providers may apply for a Swift Compatible Application label to validate the compliance of their payments application. The requirements and process are published in the Knowledge Centre.

Swift Compatibility Label Programme

The Swift compatibility label means an application complies with carefully defined requirements for Swift standards, messaging and connectivity - helping customers to choose with confidence.

Find out how to apply for a label of your application, or browse our directory of Swift Certified Applications for the solution that fits your business.

How can we help?

We are committed to making this transition as easy as possible for our community and provide consulting services to support you.

To support your operating environment in its adoption of ISO 20022, we have a comprehensive portfolio of flexible and customisable support and care services.