Information and analysis of cross-border flows to support central banks

Central banks monitor markets and transaction flows in order to understand the impact of monetary policies, to meet prudential and supervisory objectives and to support their national economies. To gain the insights they need, central banks require commercial banks to regularly report payment flows with increased frequency and granularity. This places a cost and resource burden on both the central banks, who must consolidate and analyse the information, and on the reporting banks required to extract, format and report large quantities of data.

Table of contents

Comprehensive coverage of

transaction flows

Swift Scope for Central Banks is a business intelligence solution focused on the data collection and analysis needs of central banks. The solution automates the collection and analysis of cross-border transaction flows from Swift message data, and can also collect and consolidate data from other information sources, to provide full and comprehensive coverage of cross-border activity.

The data (which is collected only with the explicit agreement of participating domestic banks) is consolidated into a data warehouse on the central bank’s premises, where it is available for analysis according to requirements.

Swift Scope for Central Banks allows central banks to collect and analyse payments data faster and more cost effectively.

Participating commercial banks also benefit by reducing the burden of manual data processing associated with regular central bank reporting of their transaction flows.

Analysis options

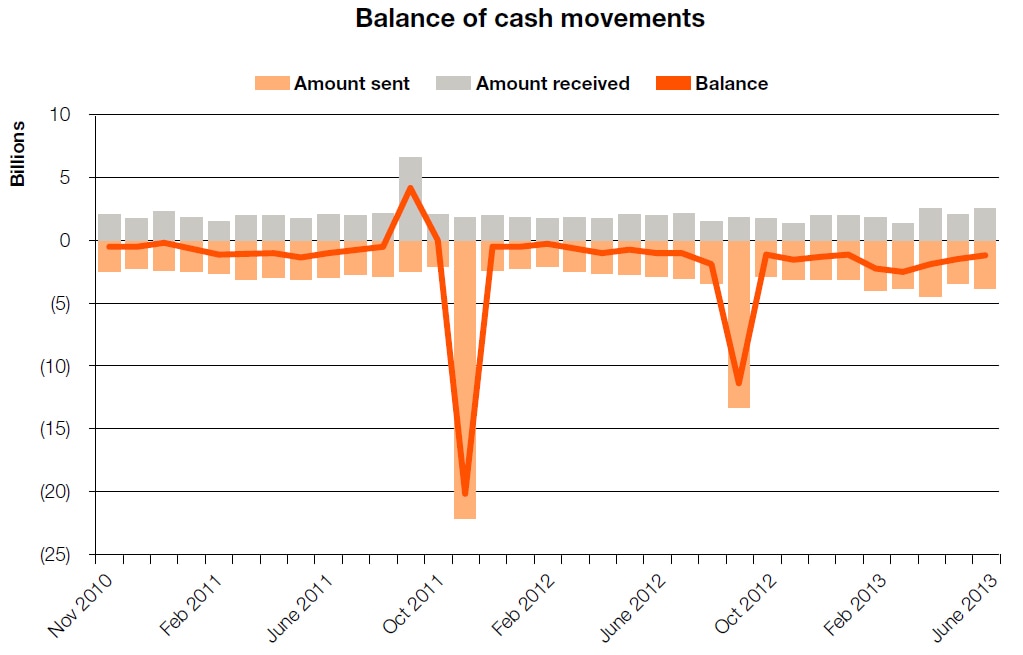

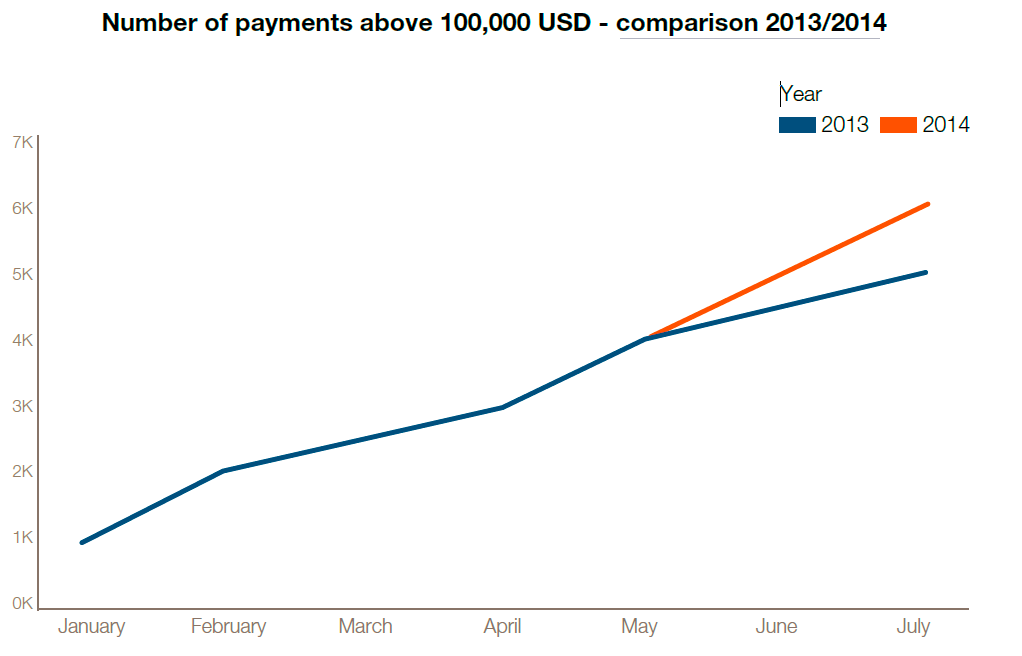

Swift Scope’s flexible analysis and data visualisation tools deliver clear, easy-to-interpret information dashboards giving central bank users powerful insights and maximum value from the data:

- Analyse payments trends,

- Monitor transactions dynamically in real-time,

- Chart cash movement balances,

- Identify sudden in-flows or out-flows of funds,

- Track outliers down to transaction level.

A flexible, end-to-end solution

Swift Scope for Central Banks is a flexible, on-premises solution ensuring complete control of data. It’s easy to implement and comes with end-to-end project management, software installation and configuration, end-user training, support and maintenance.

Depending on the customer’s requirements, a complete architecture assessment and integration service can be provided.

If you’re a central bank looking for a business intelligence solution, why not speak to us? We’ll be happy to discuss how Swift Scope for Central Banks can meet your needs.