There is an industry-wide expectation for banks and corporations to know the individuals they do business with. Any institution within the scope of Anti-Money Laundering and Anti-Terrorist Financing regulations needs to disclose the UBO’s identity for any of their business transactions.

What is UBO legislation?

Countering money laundering and terrorism financing have become top priorities for regulators in recent years. Some fraudulent parties can use off-shore accounts to mask their activity and investigators regularly trace suspicious transactions to fictional addresses, PO boxes or the private homes of unsuspecting residents.

A UBO or Ultimate Beneficial Owner is the person that is the ultimate beneficiary when an institution initiates a transaction.

The definition of who constitutes a UBO varies between jurisdiction, but generally a UBO is defined as an individual who holds a minimum of 10-25% (dependent on jurisdiction) of capital or voting rights in the underlying entity.

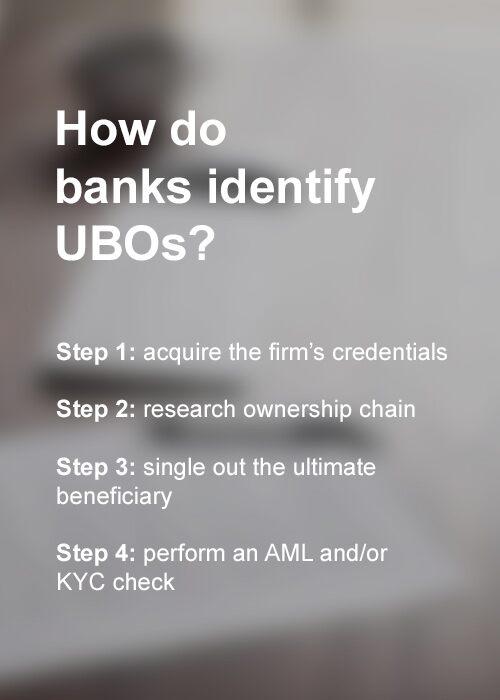

How do banks identify UBOs?

1. Acquire the organisation’s credentials

While the exact specifications vary depending on the jurisdiction and AML/CTF regulation standards, companies must supply full and up-to-date information that includes the firm’s registration number, name, address, official status and the names of top management employees for verification of legitimacy and accuracy. The Swift KYC Registry offers a base line of know-your-customer information, which drives greater efficiencies and avoids duplication in data.

2. Research ownership chain

Determine the natural or legal persons who have a percentage in shares or interests and if their ownership is direct or indirect.

3. Identify and verify the Ultimate Beneficial Owner(s)

Identify the total percentage of shares, management control and ownership stake of every individual and determine which (if any) falls under the definition of UBO.

4. Perform an AML and/or KYC check

All UBOs must go through the appropriate AML/KYC checks in a uniform and efficient way, filing consistently.

Case study: BNP Paribas and BASF

How BNP Paribas and BASF are streamlining their KYC information collection process

Mitigating risk

Estimating risk UBOs fall under different categories of risk. Ranging from low to high, they demand different approaches:

Low risk

UBOs that fall under the low risk category can confirm their identity by signing a statement listing their details. It is also sufficient to perform a visual check against identification documents.

Medium to high risk

If the person identified shows any signs related to terrorism or money laundering, further investigation is required that may include but is not limited to:

1. Additional searches to collect information to assess the customer’s risk profile including political exposure, adverse media coverage and legal enforcement measures that could contribute to risk;

2. Analyse the individual’s source of wealth and funds, and register any discrepancies between income, source of wealth and overall net worth;

3. Gather additional information about the purpose and intended nature of the business relationship;

4. Annual updates about changes in substantial ownership.

What is the scale of offenses?

According to the International Monetary Fund (IMF), money laundering and terrorism financing amounts to around 1,000 billion EUR – between 2.5 and 5 per cent of the world’s GDP. In the past few years the number of reports featuring indications of money laundering or terrorism has increased dramatically.

It is for this reason organisations now go through UBO checks to demonstrate compliance with Money Laundering and Terrorist Financing (Prevention) Act. Failure to do so can result in steep penalties.

Case study: BNP Paribas and BASF

How BNP Paribas and BASF are streamlining their KYC information collection process