Screen financial transactions against sanctions automatically on our network

Flexible and customisable screening configurations and routing rules

Choose to screen all your structured message formats in real-time (including MT, MX, ISO 20022, such as SEPA) or opt to only screen your incoming or outgoing messages and can screen domestic traffic, cross-border traffic, or both.

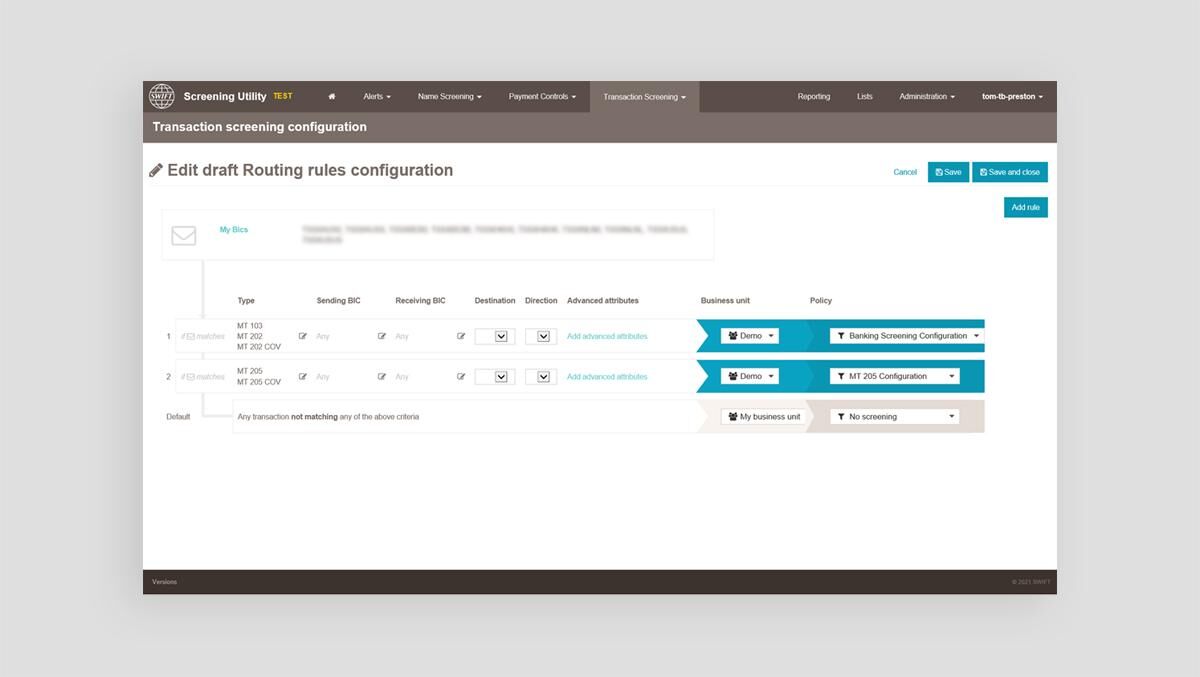

Transaction Screening offers an additional layer of customisation to make sure you only screen what you need to. Create your own rules and apply them to transactions that meet specific criteria, like message type, currency, amount or destination, and choose whether to block or allow flagged messages to continue.

You can also implement exception or suppression rules to reduce false positives and apply an optional ‘four-eyes’ workflow for additional security.

Real-time, smart screening for the ISO 20022 world

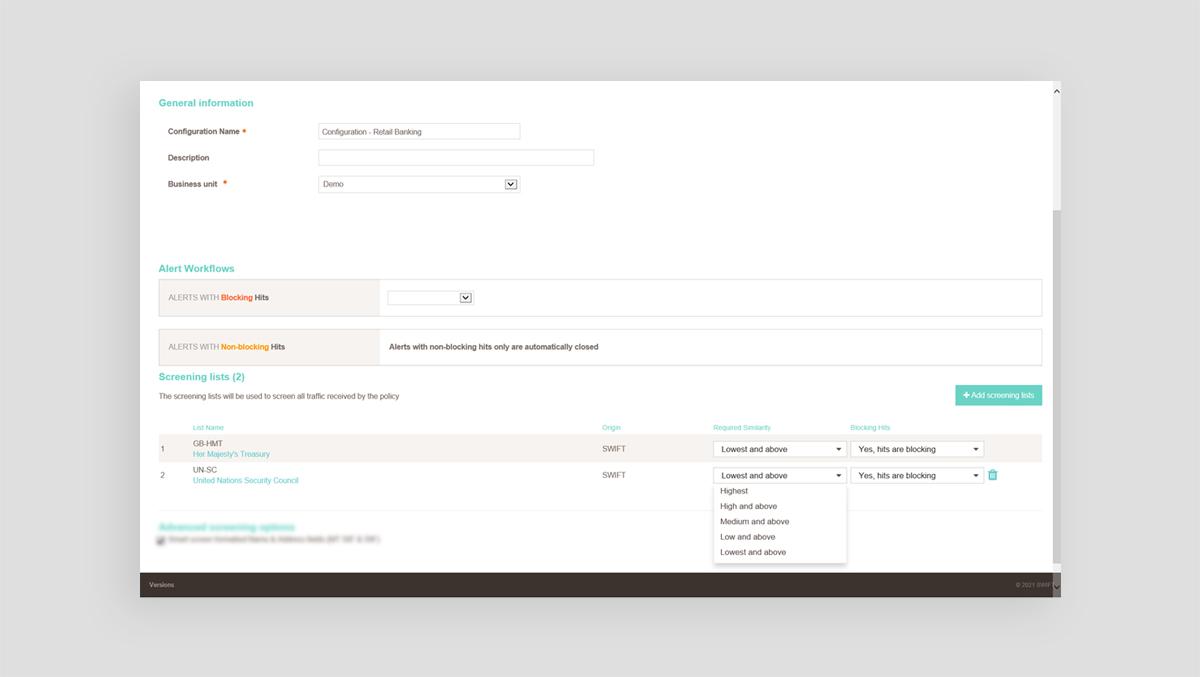

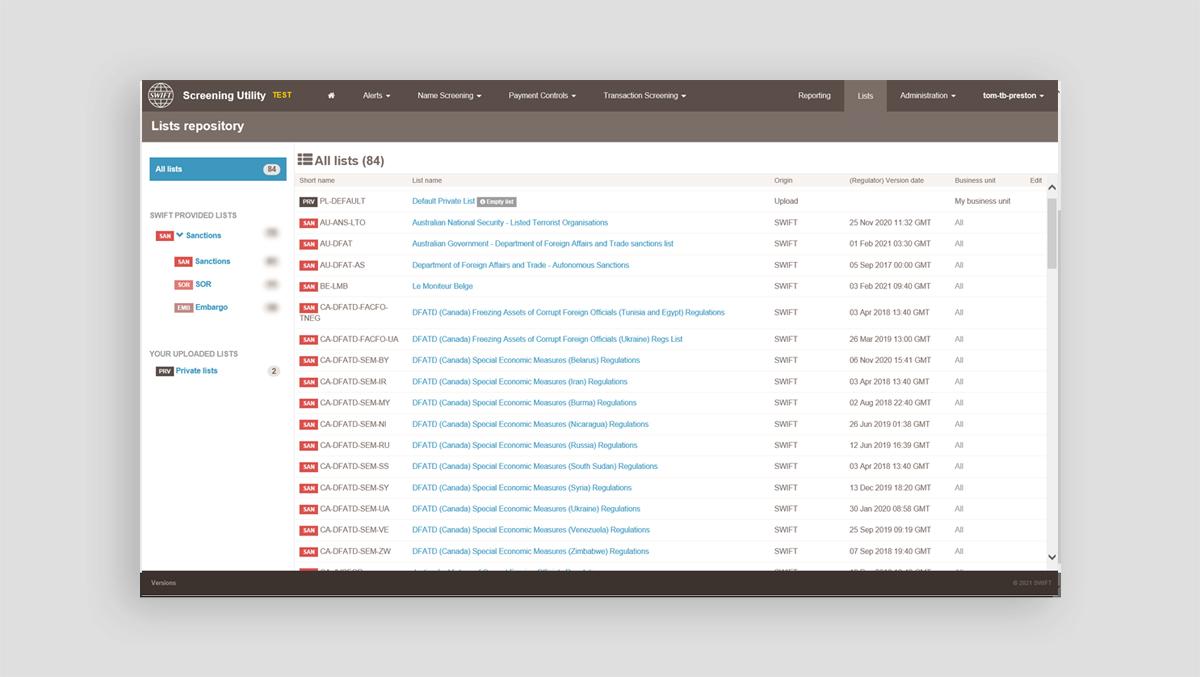

Swift’s Transaction Screening service screens your messages in real-time against over 90 comprehensive sanctions lists typically updated within 8 hours after publication.

Use our new Smart Screening to leverage the extra data fields that ISO 20022 messages contain to reduce false positives.

We take care of the complexities for you: hosting, managing and maintaining the screening engine, including a range of logical tests (to detect misspellings, abbreviations and phonetic similarities) and sensitivity thresholds to accommodate your screening logic to your risk appetite.

Transaction screening also offers a slick alert management functionality built into the tool and is designed to make it simple to identify the alerted entity and make important decisions.

Place order for Transaction Screening

Screening your incoming and outgoing financial transactions against sanctions.

Screen all your transactions in one place

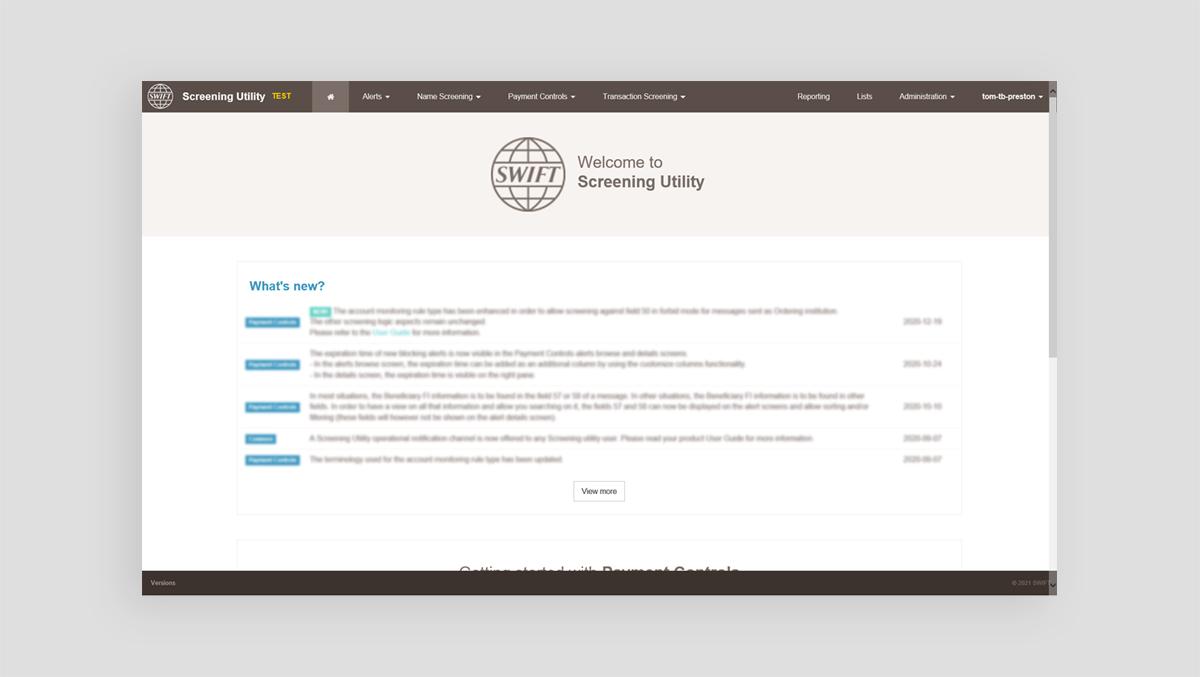

As part of our screening and fraud solutions, Transaction Screening is hosted in a single portal alongside our Payment Controls solutions.

Transaction Screening is a fully managed service that requires no infrastructure on your side. Your institution can be quickly up and running. We take care of the heavy lifting, leaving you free to act on suspicious transactions.

Independent quality assurance

For added reassurance, Swift has commissioned regular independent reviews of the effectiveness of Transaction Screening. These reports provide transparency around filter capabilities, as well as generic and user-specific filter configuration settings.

Got a question about Transaction Screening? Get in touch with our experts.