International drawdown: an alternative to direct debit

Table of contents

If you are unable to arrange a direct debit with a bank connected to European or US Automated Clearing Houses, our international drawdown (IDD) service offers an alternative.

About IDD

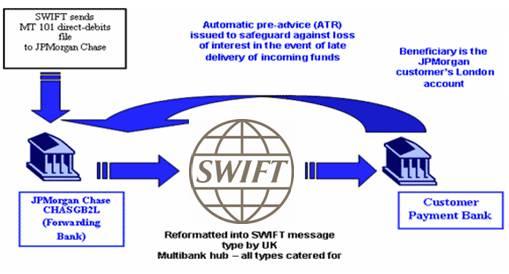

Based on MT 101 messages, IDD automatically processes payments from a designated payment account by using the existing international correspondent banking payment infrastructure.

Rather than having to open a EUR account in Europe or a USD account in the US, you will need to hold a EUR or USD account within the IDD footprint. Our chosen service provider, JPMorgan Chase, has established IDD bilateral agreements with over 500 banks in 70 countries. We can advise whether your chosen bank is part of this footprint.

Benefits of IDD

- Simplicity. IDD offers a simple way of paying bills that removes the risk of late payment or disconnection from Swift.

- Efficiency. Using existing, highly resilient international payments systems, IDD delivers the efficiency gains of MT 101 automation and straight through processing.

- Reconciliation. IDD offers straightforward debit reconciliation, enabling the fully automated updating of accounts. The process is completely transparent and can be audited – reducing or eliminating back-office maintenance and support costs.

- Refunds. IDD offers a fast and simple refund procedure.

In addition, IDD minimises the following risks:

- Operational risks arising from the continued and assured use of Swift.

- Financial risk arising from unrecorded liabilities, incorrect booking of invoices, overpayments or duplicate payments.

- The risk of unauthorised payment. You can block an invoice at any time, preventing any unapproved or incorrect disbursement.

Swift repays all credits or rebates immediately, and subscribers enjoy 40 days’ free credit.

How to subscribe

If you want to subscribe to IDD, the first step is to find out whether Swift invoices you in USD or EUR. You can find this out from your Swift account manager, your Swift business partner or the Swift Treasury Department (e-mail: Treasury.Generic@swift.com).

You will also need to find out whether your USD or EUR payment bank is registered in the IDD footprint. Find out by contacting the Swift Treasury Department, your Swift sales office or your business partner.

In order to subscribe to IDD, follow these steps:

- Download the EUR Drawdown Form or USD Drawdown Form.

- Complete and sign the form and send it to your payment bank.

- Your payment bank will send you additional documents to sign in order to register you to the drawdown electronic banking service.

- Complete and return the documents required by your payment bank.

- Ensure that your payment bank completes section three of the form that confirms registration and set-up of the settlement account on the drawdown service.

- Send the form to Swift Treasury Department, Avenue Adèle 1, B-1310 La Hulpe, Belgium. We will then send you confirmation of your registration.

Debit process

- Once you have registered, we will send you a test transaction of 10c to your account. This will be credited back to you on the first live run.

- Approximately seven days before the direct debit date, we will send you an MT 999 showing the invoices and credits that you must pay or that will be refunded to you.

- JPMorgan Chase sends the MT 101 direct debit payment instruction to your payment bank via Swift.

- Your payment bank makes settlement to the Swift account with JP Morgan Chase in London.