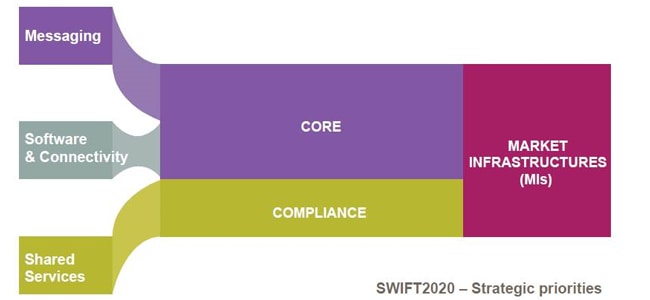

Swift's recently published strategy, "Grow the core, build the future" sets out an ambitious agenda for the next five years.

At the highest level Swift2020 is about "continuity of operational excellence and strengthening of our core, combined with significant new areas of innovation," says Javier Pérez-Tasso, chief executive of the Americas, UK, Ireland and Nordics, who recently moved from his previous role as chief marketing officer, where he led the global development of the strategy together with the Swift community. This balancing act of continuity and change may appear contradictory, but Pérez-Tasso believes that both are fundamental prerequisites to assure and accelerate growth.

Primary focus on the core

Swift2020 therefore sees Swift continuing to focus on operational excellence in its core financial messaging services in order to deliver on the highest expectations of customers, while also addressing new cyber-security and geopolitical challenges. The relentless focus on the core will also be accompanied by efforts to continue reducing costs for customers. "Over the last three strategic cycles, Swift has significantly decreased the average costs of its messaging services, notes Pérez-Tasso, "and in line with our cooperative approach, we will continue to pass on the benefits of economies of scale to our customers."

We see ourselves as innovative incumbents; we are proactively coming up with new technologies and platform innovation.

With rapid change and disruption occurring in both payments and securities landscapes, ramping up innovation in Swift's core business is very much on the agenda. "The digital revolution is in full force in the financial sector, and our customers are influenced by new technologies, regulation and evolving expectations," comments Pérez-Tasso. "At the same time, new entrants are challenging and potentially disrupting the traditional business models of transaction banks." There is clearly no room for complacency, and Pérez-Tasso reinforces that Swift is also part of the change. "We see ourselves as innovative incumbents; we are proactively coming up with new technologies and platform innovation - particularly in the area of real-time payments and compliance - and we are working together with banks to consider ways of rejuvenating the correspondent banking model."

In addition to serving core correspondent banking and securities settlement and reconciliation clients, Swift also intends to focus on deepening engagement with lower volume Swift users such as corporates, (particularly in the mid-sized segment) and investment managers. "Developing comprehensive solutions for investment managers is an important dimension to our growth strategy, which will bring additional benefits to our core community," notes Pérez-Tasso.

Market infrastructure expansion

Innovation will also be a clear focus in the market infrastructure (MI) segment, a second major pillar in the strategy. The focus is on deepening the support provided to communities, growing services, both international and domestic, and addressing the needs of RTGS systems and CSDs. In addition, Swift will launch new offerings to enable ISO 20022, and focus on an expansion of resiliency services. And one of the biggest growth accelerators identified in the strategy will be Swift's entry into domestic real-time payments, with a first project in Australia now underway.

Financial crime compliance

The third major area of expansion and innovation is in the area of financial crime compliance. Swift first launched its Sanctions Screening and Sanctions Testing products back in 2012, and added The KYC Registry and Compliance Analytics in 2014. There are now plans to build on these services and move to the next level. "Under the Swift2020 strategy, we are proposing a five-year vision to move towards a single financial crime compliance utility which over time will serve as a ‘one-stop' solution" says Pérez-Tasso. "We are co-creating products together with the community, because that way we know they are solving the real operational challenges our customers face."

Listening to the voice of the community has been an integral part of the strategy development process, and has directly opened some new directions. One such example is the extension of financial crime compliance services to securities, where the community indicated an appetite for Swift to play a role. "The securities industry is also grappling with major challenges around regulation and compliance. Our KYC Registry is now open to fund distribution players and we are also considering ways in which our portfolio of screening solutions could support adherence to regulatory principles."

Hitting the ground running

As the strategy now moves into its implementation phase, Christian Sarafidis, newly appointed chief marketing officer and previously deputy chief executive, EMEA, now takes the helm.

He views the plans in the market infrastructure segment as particularly significant, and identifies wider potential for the real-time infrastructure components which will be developed for the New Payments Platform (NPP) in Australia. "The underlying technology created for this project has the potential to be redeployed in other geographies and markets," says Sarafidis. "We intend to build on the Australia project experience to offer solutions across multiple geographies."

Our innovative approach to real time payments has strong potential in other geographies and markets.

The securities market infrastructure landscape is particularly dynamic as a result of structural changes in post-trade, such as T2S, and significant momentum behind regional integration projects worldwide. "The securities segment forms an integral part of our MI strategy," notes Sarafidis. "As roles are redistributed in the value chain, we are ready to offer support. A key focus will be on industrialising the use of our second generation MI technology solutions so that all CSDs can benefit from solutions that are tailored to their business needs."

He is also keen to drive Swift's engagement with both the MI and banking communities to enable smoother transitions to ISO 20022. "Not only do we have a great set of tools and products to help individual institutions, we also have a vital community role to play. During Sibos we will be bringing together market infrastructures from around the world to promote cooperation on standards and to address future interoperability."

Serving MIs and geographical expansion go hand-in-hand. With new regional offices opened last year in Mexico City, Accra, and Nairobi, there will be a clear focus on addressing the changing needs of domestic and regional MI communities, across high growth geographies such as Asia Pacific, Latin America, Africa and the Middle East. In his previous role Sarafidis led growth in Africa, witnessing a 51% growth in payments traffic between 2011 and 2014. Pérez-Tasso now turns his attention to implementation of the strategy in Latin America, where growth potential is high, while chief executive of Asia Pacific and EMEA, Alain Raes, continues ramp-up in Asia Pacific, Africa and the Middle East.

And while Compliance services is one of the headline areas of the Swift2020 strategy, Sarafidis underlines that product innovation is not limited to compliance. Plans are underway to launch SwiftScope, a new on-premises version of Business Intelligence to enrich transaction monitoring and intraday liquidity reporting, SwiftRef expansion is ongoing to provide a global utility serving local communities' reference data needs, and further integration of MyStandards with Swift and non-Swift products continues.

As the ambitious plans for continuity and change converge, both Pérez-Tasso and Sarafidis stress the importance of feedback from the community throughout the execution phase. "We look forward to Sibos and the opportunity to engage with our customers both through the conference programme and informally," says Sarafidis. "We want to make certain that our new Swift2020 strategy is implemented as effectively as possible to meet the most pressing needs of the community."